Top image: Fortnite. Developer Epic Games fires 830 people this year.

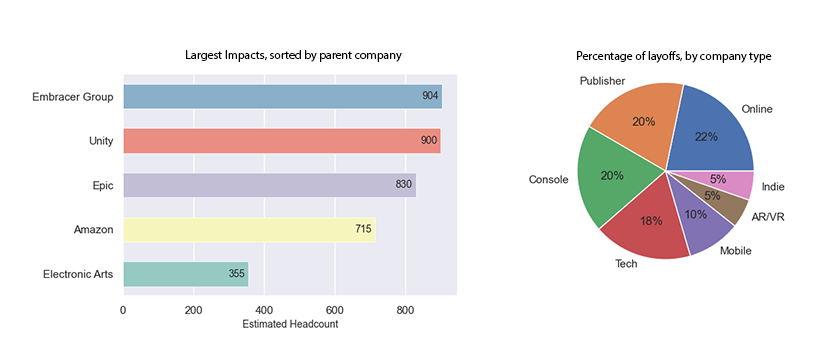

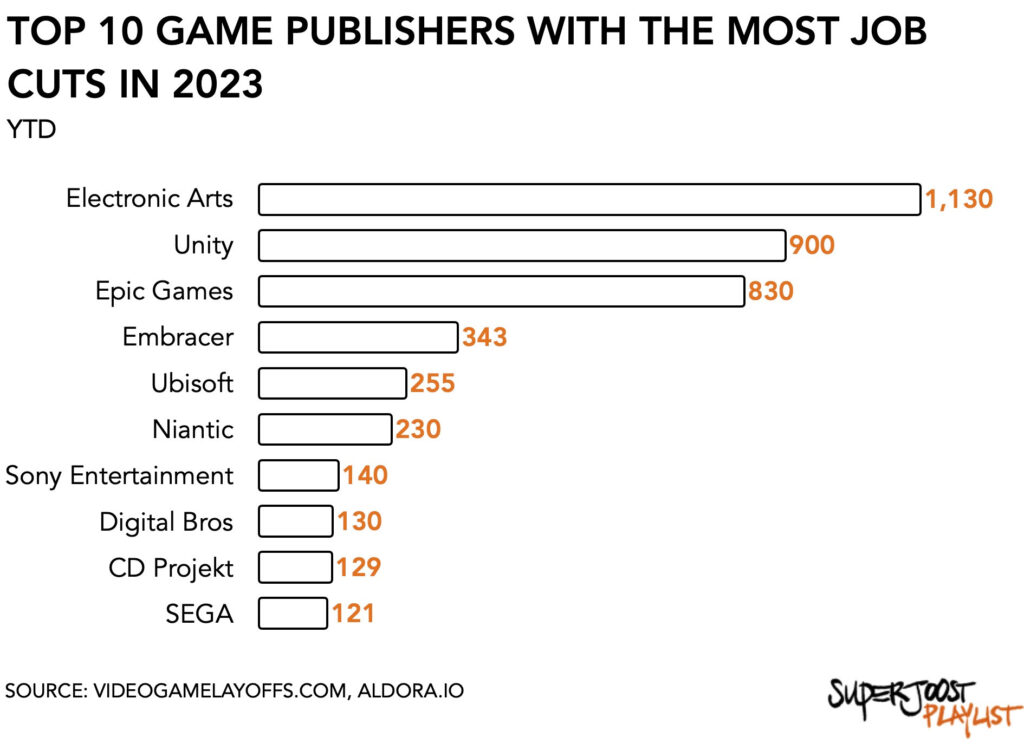

The games industry is doing better than it’s ever done. It is also cutting costs and laying off staff at an alarming rate. According to videogamelayoffs.com, a site that tracks public announcements across the industry, a reported total of 8,000 people have lost their jobs in gaming in 2023.

Reducing headcount is a tactic that goes over well with investors. Generally speaking, a cost reduction improves a firm’s profitability and with it its share price. Embracer, for example, regained favor from investors last week. Its share price jumped +11 percent after it reported better-than-expected operating profits in its second-quarter earnings. The Swedish games conglomerate is in the midst of a bloody restructuring and has been culling its personnel expenses. Similarly, Amazon Game Studio announced the termination of 180 jobs. And Digital Bros and Kongregate also joined the ‘wave of video game industry layoffs.’

Overhead is generally the largest expense on the books of any development outfit or publisher. Reducing headcount is by far the easiest way to reduce costs and return to something resembling profitability.

Postpone pricey acquisitions

However, because building up human capital is costly and slow, making cuts following a rushed acquisition is destructive. Better than, perhaps, to look for alternatives elsewhere first. One way would be to postpone pricey acquisitions to avoid creating financial vulnerabilities. After SEGA completed its $776 million acquisition of Rovio in August it is now allegedly threatening with mass layoffs in response to unionization.

Another is to reach out to your largest vendors and service providers (e.g., engine software providers, payment facilitators, platform holders) and renegotiate the terms of your most expensive contracts. During Embracer’s annual meeting, its CEO Lars Wingefors blamed the growing power of platforms: “In reality, we are paying more fees to platforms than we spend on games development every year.”

Long-term impact of layoffs

Whatever the justification, the long-term impact of layoffs is two-fold. First, reduces on-ramps even further. Unlike the film and music industry, there remains a dire absence of ways for young talent to enter the games industry. After completing a game design course, there simply isn’t an active effort among publishers to go and recruit people. From my vantage point, there are plenty of recruiters from a variety of industries crowding the NYU campus to bring new blood to their organizations every year. Game companies remain mostly absent, despite New York’s growing prominence as a hub for investment and creativity in interactive entertainment.

It further exacerbates the circumstances of those people whose presence is desperately needed (e.g., women, and people of color). It reduces the already paltry diversity at the core of the games industry and neutralizes the talent heterogeneity that tends to lead to breakout successes.

Onslaught of mediocrity

Second, it presents an onslaught of mediocrity. The increased risk profile of interactive entertainment, especially against a background of rising platform fees and marketing expenses, pushes innovative new content to the back burner. Parent organizations tend to forfeit the potential of innovative novelties in favor of their subsidiaries’ proven franchises, shelving such projects in a freezer somewhere, never to be thawed.

It also pushes innovation to the bottom half of the industry’s supply side, forcing smaller firms with less access to capital to take on more risk to compete. That makes them vulnerable and can result in a disproportional impact when forced to let people go.

For instance, so far French publisher Ubisoft has reported a total of 255 layoffs in 2023, which represents 1.3 percent of its global workforce of 19,409. Niantic, by comparison, cut a similar number of jobs (230), but for the Pokémon Go-maker that represented almost 22 percent of its total headcount. For one firm, layoffs are a rounding error meant to improve efficiencies; for another it’s a bloodletting.

Privately-held vs publicly traded

Similarly, organizing the twenty largest layoffs by company structure (in absolute terms for 2023 year-to-date) shows that small, privately-held studios have let go of a greater share of staff compared to publicly traded firms. Privately-held firms, including Epic Games and Niantic, have shed 18 percent of their workforce compared to 3 percent for publicly traded game makers. Smaller, mostly privately-held game makers have had to let go of substantially larger groups of people.

Despite taking more risk when creating new intellectual property and innovations. To capture market share they pull out all the stops to deliver something truly unique and different. Losing a fifth of their workforce, however, inevitably makes them more conservative in their approach.

Cacophony on digital distribution platforms

With few opportunities to join a larger organization, many game devs choose to build their own portfolio or start their own indie studio. Sure enough, they have a few great ideas they’d like to pursue. But even if those projects see the light of day, they mostly end up drowned out by the cacophony on digital distribution platforms like Steam. That leaves established franchises dominating the charts as consumers turn to well-known titles.

As the nominations for this year’s edition of the Video Games Awards are rolling in, a now four-year-old suggestion seems more pertinent than ever. How about an annual industry reward for reducing costs without laying people off? Call it an S-rank achievement.