2022 Predictions #2 How to win after Fortnite's 💀 and Why Going Cross-Platform is Mandatory for Mid-Core Games

This prediction is written by Michail Katkoff and Buğrahan Göker. Access all previous predictions here.

This report wouldn’t be possible without the help from our friends at Sensor Tower. An essential data platform for all mobile gaming studios.

In this analysis, data from China, Korea, and Japan are excluded as this analysis focuses on Western markets only. This is because we don’t want to reduce the actionability of the data with games that succeed massively in what can be described as closed domestic markets. Please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise of accuracy.

With Xsolla you can easily launch your own cross-platform player account system Let your players stay connected and engaged no matter which platform they play on. The money you save on platform fees will go directly into further improving and growing your games.

This analysis is sponsored by Xsolla. You’re reading this likely because you’re interested in the mid-core market. Well, one of the biggest trends in mid-core games is growing your business on mobile and beyond. If that’s your goal as well, look no further. Xsolla has dedicated tools that will help you create your own online commerce platform, improve your performance marketing and discoverability, and expand your game business on mobile and PC. Check out Xsolla’s solutions for more information.

Mid-Core is Where the In-App-Purchases are Made

In 2021 the Mid-core category continued to dominate on the revenue side, bringing 45% of all In-App Purchase (IAP) revenues in mobile markets (excluding China, Japan, and Korea). The overall IAP revenues reached nearly $15B, which is 16% more than in 2020.

The most significant growth in revenue was seen in the following sub-genres:

Open World Adventure is a newborn sub-genre that grew by 622% this year. Genshin Impact is the primary driver of growth, and in fact, the game solely represents the sub-genre and has more than 95% market share.

Card Battlers continue to grow every year, with no exception in 2021. Although the installs plunged by 16%, revenues are up by 45%. Mighty Party, Magic The Gathering Arena, and Yu-gi-oh Duel links contributed to revenue growth. On the other hand, Hearthstones' revenues fell by 16% and currently sits in 5th position after many years as the top-grossing game.

The biggest sub-genre on mobile in terms of revenue is 4X Games, which also had a good year. The revenues increased by $850M (+27%). Even though no significant new games climbed to the top this year. Almost every title managed to increase its revenue in 2021.

Real-Time Strategy (RTS), which has been a declining sub-genre for a few years, finally bounced back in 2021 due to the growth of Clash Royale. Clash Royale, which makes 70% of all sub-genre revenues also saw growth in downloads, which indicates that Supercell’s renewed investment into performance marketing paid dividends.

FPS/3PS grew by 30% and became half a billion-dollar sub-genre in 2021. Most of this growth is from Call of Duty Mobile, which makes more than 90% of the sub-genre.

Mid-core games tend to focus on deeper meta-games that offer good long-term monetization. Thus these games rely more on performance marketing to find high-value players. As the IDFA depreciation hit the iOS market, we started seeing a decline in downloads. The downloads slipped by nearly a fifth compared to 2020 as nearly all sub-genres excluding three saw installs declining.

There were only three sub-genres in mid-core that had their downloads up from the prior year:

Open World Adventure (growth of Genshing Impact)

Hack and Slash (launches of Marvel Future Revolution and MHA: Future Hero)

Action RPG (lifted by the launch of Cyberika)

The sub-genres that saw the largest decline in downloads is an unfortunately long list::

Move and Shoot (Archero declined and there was no game to take the spot)

Beat ‘em Up (decline across the board. Shadow Fighter and City Fighter vs. Street Gang suffering the most in terms of absolyte downloads)

Turn-based RPG (decline across the board. Call Me a Legend and Girl X Battle amongst the ones to suffer the most)

FPS/TPS (Some games scaled up significantly while the largest ones saw massive drops. Call of Duty Mobile, for example, was down 40M downloads YoY)

Sniper (Sniper 3D led the decline with a drop of over 30M compared to the last year)

Build & Battle (decline across the board with Castle Clash, Forge of Empires and Boom Beach leading the way)

Overall, the evolution of the mid-core category is much like we’ve expected it to be. The genres that rely on long-tail monetization kept growing despite an often significant drop in downloads. We saw many games broaden their appeal by bringing in Hollywood IPs and/or doing massive investments into super high-quality ad campaigns.

The $6.5B 4X Games Genre

We can’t talk about Mid-core games without diving deep into the largest genre and the largest sub-genre on mobile. Strategy games continued to grow bringing in $6.5B, out of which $4B was generated by 4X games alone. What’s even more impressive is that this already behemoth of a sub-genre is that the revenue outpaced the overall market pace delivering a 21% increase year of the year with a decline in downloads of only 4%, which is significantly less than what mid-core games saw their downloads drop on average.

To put the Strategy genre in proportion, it generates a whole Billion more than all Puzzle games combined. Though several puzzle genres do boast significant ad revenue streams, which bridge the gap in net revenue between the genres.

The biggest acquisition in the sub-genre happened last year, with Applovin acquiring Machine Zone - the company that made some of the most iconic top-grossing 4X games of all time (Game of War, Modern Strike, Final Fantasy: New Empire).

One of the possible outcomes of this acquisition was growing Applovin's 4X title (West Game) by employing MZ’s data and core competencies. If this was the strategy, it didn’t pan out. MZ’s portfolio revenues have collapsed by 40% (From $168M to $100M) as have the downloads of West Game (-25%). While the decline is stark, it shouldn’t come as a surprise for those versed in the genre. MZ’s 4X engine was already behind the curve at the time of the acquisition and sadly they weren’t able to use their know-how to support West Game’s growth.

Apart from that, we haven’t seen consolidation in the market. This is perhaps because successful assets are very expensive and it is cheaper for an existing 4X publisher to launch and scale new titles rather than to acquire and operate existing games that have already scaled.

Zooming out of 4X games provides some very interesting insights:

#1 Low level of concentration. Up to 31 games in the 4X sub-genre made over 20M in net revenue in 2021. And 15 titles crossed the $100M in net revenue. 4X games are notorious for having a relatively small number of players that monetize significantly above the average. This creates a very healthy sug-genre that is welcoming for new games.

For the longest time the strategy in the 4X genre was to have multiple titles that were skinned to cater to different audiences. Think of Fun Plus with their King of Avalon, Guns of Glory and Left to Survive. Or Lilith, with Rise of Kingdoms and Warpath. This strategy is supported by the structure of a 4X studio where the live service team is often separated from the core tech and the publishing team. In other words, because the games are inherently identical, one live service team can operate several ones at the same time.

The ability and incentive to launch multiple titles to grow overall share of the market is perhaps the key reason why the market is and will remain fragmented.

#2 Dominated by Chinese publishers. Gone are the days when Kabam’s and Machine Zone’s games defined the 4X market. As of today, it is nearly fully controlled by prominent Chinese publishers such as Fun Plus, Lilith, IGG. And publishers who choose to be somewhat secretive, such as River Games and Long Tech Network Limited. Why some of these Chinese publishers choose to remain unknown should definitely raise eyebrows. If you’re hiding this type of information, what else are you keeping under the lid?

Scopely’s Star Trek Fleet Command is the only 4X game from a Western developer with a spot in the top 10. The game represents fantastic IP integration and true product innovation. It is by far one of the most accessible games in the genre - if not the most. Interestingly enough, accessibility can also be seen as best-in-class revenue-per-download.

#3 Product innovation is crucial. 4X games can’t scale by exclusively poaching users from other games -- they need to be able to recruit new audiences to achieve long-term unit economics viability. Successful 4X games developers are constantly bringing new gameplay mechanics to stand out in the market as seen in the examples below. Lack of product innovation on the other hand is what can be contributed to the decline of past winners in the genre, Kabam and Machine Zone.

#4 High entry barrier. Despite the low level of concentration and over a dozen games crossing $100M in net revenue, 4X games are notoriously difficult to build, operate and scale. They may not look like much, but you shouldn’t judge a book by its cover. The technical expertise to run these strategy MMOs combined with live service excellence is something only a handful of studios can do successfully.

#5 Marketing excellence. Ever since the rise (and fall) of Machine Zone, 4X games are known for over-the-top campaigns with the likes of Arnold Schwarzenegger and Conor McGregor at the forefront promoting the games. Since the IDFA-deprecation, the role of wide appeal has further increased. Top titles regularly integrate known Hollywood IPs and/or invest into brand building. And the results are as impressive as the marketing campaigns.

Last year’s comets all had IP integration as part of their marketing strategy. Top War, which increased yearly net revenues by nearly $200M, had Transformers. The Fun Plus’ State of Survival, which made nearly half a billion Dollars in 2021, worked with both Walking Dead and Joker. Lilith’s Rise of Kingdoms on the other hand decided on a niche IP, integrating Ninja Gaiden and in the process losing their number one spot in the genre.

Several of the top performing 4X games employed IPs to broaden their reach in the post-IDFA era. Also, why make an IP-based game anymore if you can rotate top IPs? Just look at State of Survival, which made nearly half-a-billion in net revenues in 2021.

In addition to IP integrations we also saw 4X games release outstanding creatives. Just take a look at the release trailer for Lilith’s Warpath. A true masterpiece of an ad rivaling launch trailers from AAA games. Warpath later brought on Jean Claude Van Damme as their creatives along with pulling 100M in gross revenues in 2021.

Arguably one of the best ads for a mobile game ever made. Well played, Lilith…

Last Year’s 4X Predictions

2022 Predictions for 4X games

We’ll see even more external IPs in the 4X genre.

This is an easy prediction to make as nearly half of the top-10 titles all had IP integrations in 2021. Well-chosen and integrated IPs help to broaden the marketing funnel and ‘fool’ players to play a game they would never have installed otherwise. In the long-term, this misleading marketing is not the most sustainable strategy and next year we’ll likely make an opposite prediction. Games with proper IP integration, like Scopely’s Star Trek, are safe from this bubble.

Downloads will continue to decline double-digits across the board.

IDFA is wreaking havoc across the 4X games, which rely purely on whale monetization. Limited targeting combined with misleading ads and sky-high CPIs is a toxic combination. 4X publishers are extremely analytical. I’m sure they know what they are doing. But it’s hard to see them keeping up current download levels.

Nearly all titles will have their PC SKUs

As mobile becomes more difficult, we’ll see titles moving to PC. This is not to increase the player base. The goal is to extract more value from the high spenders by encouraging them to make purchases outside the app stores.

Supercell’s Everdale will launch globally

In the current iteration, the game is good but not great. Yet we have confidence that Supercell will be able to correct all the known issues (read: Supercell's Everdale: a Genre Definer or a Pretty-Looking Social Appointment System?).

Shooters have the same amount of players as Hypercasual games

Everyone knows that hypercasual games get most of the downloads, which naturally leads to a massive amount of daily active users playing these games. But not everyone knows that there are virtually the same amount of players playing shooters on mobile as there are those playing hypercasual games.

While hypercasual and arcade games boast nearly unlimited amounts of downloads, when looking at the daily active players, shooters are actually neck-to-neck with these two genres.

Overall, the downloads in the Shooter genre declined during 2021 by a whopping 27% from 2.6B to just under 2B. At the same time, the revenues continued to soar, reaching 2.4B, which is 14% more than in 2020. These numbers indicate that the third wave of shooters has hit the shore and the market is mature until the next wave will raise it to new heights.

What are the waves, you ask? Well, it all started with those Sniper games, where players simply aimed and shot without moving. These games were perfect for smaller screens offering a straightforward single-player experience. The second wave was brought in by the vehicular shooters. Unlike with Sniper games, you could move and you were actually fighting other players. But the movement was slow and you often had to stop to shoot. Perfect for a battle in the 3G network. The third massive wave came as the networks hit 4G, the screen size was 6 inches and the Battle Royale craze was climbing towards its height. What will be the fourth wave? Read on, because you have to understand the past before you can predict the future.

The Shooter genre comprises four sub-genres:

There are four shooter genres on mobile. Though given the latest trend of having multiple types of games in one app, the division between classical TPS/FPS games and Battle Royale games is bit vague. In other words, you could place Call of Duty Mobile under Battle Royale genre, which would radically reduce the size of TPS/FPS games.

Battle Royale focuses on a last-man-standing player vs. player Battle Royale mode, often featuring drivable vehicles and little to no power progression. This genre generates 75% of all shooter revenues - and if we would allocate Call of Duty Mobile under Battle Royale instead of Tactical Shooters, Battle Royale would be closer to 90% of all revenues.

Tactical Shooters with a first-person or third-person perspective, similar to traditional PC or console games. These games feature real-time combat and competitive PvP gameplay. At large this has been a dormant sub-genre, if not taking Call of Duty mobile into account. The launch of Valorant Mobile in 2022 is likely to invigorate it considerably.

Vehicular Shooter with 3rd person perspective, mainly controlling mechanical vehicles like aircraft, robots, and tanks. Strong power progression and much slower pace make

These games are more suitable for mature audiences. This genre rarely sees new games. There’s only one new game to talk about and that is Plarium’s Mech Arena which is showing signs of success. Knowing Plarium, this game will likely find its way on other platforms as well.

Sniper Shooters are games with sniper rifles as the primary weapon and aiming as the core gameplay. The player doesn’t move from their location. Sniper games focus on single-player-oriented gameplay with power progression through weapon upgrades. These games are largely legacy titles at this point. The smartphone screens have grown significantly over the years making games with touch-control d-pad the norm and thus Sniper games obsolete.

The $3.5B Battle Royale genre

Battle Royale remains the dominant Shooter sub-genre with $1.6B in revenues and a growth of 14% year-over-year. At the same time, we saw the installs slide 21% from nearly 800M to just over 600M. This dip occurred despite the launch of two ‘sequels’ in PUBG New State and Garena Free Fire MAX.

Garena Free Fire was the biggest beneficiary of Fortnite’s removal. Not to mention the banning of Tencent’s PUBG Mobile in the Indian market, which further helped Garena Free Fire as it grew to become the biggest shooter outside China.

The removal of Fortnite is a factor, as the game would have driven a considerable amount of installs on mobile with its fantastic season structure had it not been banned from the stores in August 2020. Nevertheless, it’s the decline of downloads across all key franchises that is the real factor.

All four of the major franchises saw a decrease in downloads in 2021. Free Fire (-11%), PUBG Mobile (-25%), Call of Duty (-38%) Fortnite (💀). In case you’re wondering, July 21’ was the launch of PUBG India that replaced the banned Tencent version.

Despite the decrease in downloads, key franchises, with the expectation of Fortnite (💀) continued to outperform the market. Free Fire (+60%), Call of Duty (+31%), PUBG Mobile (+13%)

Battle Royale games focus on a last-man-standing player vs. player mode. These games often feature open maps with drivable vehicles and little to no power progression. Lack of power progression means that the games monetize mainly through cosmetics and thus rely on a murderous content treadmill of visual exciting seasons. The treadmill that only the largest studios in the world can sustain.

How to get the Chicken Dinner in the Battle Royale

Despite the decline in downloads, Battle Royale remains the crown jewel of shooter games on mobile devices generating over 150M in net revenues every month (excluding China, Japan, Korea, and Call of Duty Mobile). The sustained success and the fact that there are several prominent mobile publishers and as well as shooter IPs still absent from the genre leads to new market entries following four different entry strategies.

There are so many great battle royale games you’ve never even heard of. For somewhat reason Net Ease is usually behind the half of them.

👎Battle Royale with Better Production Values

One would assume that offering a similar game with a more interesting setting and significantly improved graphics would assure a lucrative slice of the hefty Battle Royale pie, right? As we’ve seen from multiple high-production-value games from NetEase, players who play Battle Royale games are not easily swayed by the looks.

The reason why a game with improved graphics has a hard time taking market share in Battle Royale - or any other free-to-play genre for that matter - is that players have invested considerable amounts of time and effort into the games they are currently playing with their online friends. They are engaged in guild competitions and are progressing through ever more interesting battle pass seasons. Improved graphics might be worth a try. But it’s not worth starting essentially the same game all over again without most of the online friends you’ve made in the past year(s).

Takeaway: In free-to-play games, players don’t leave the game; they've invested countless hours for a similar game with better production values.

👎/👍 Battle Royale with an IP

Final Fantasy’s Battle Royale game has been a dissapointment. EA’s two key franchises are still in soft-launch with a mixed bag of early results.

Launching a similar game with an IP is in theory a good strategy as it couples a proven game with high marketability. In other words, IP should give you more players for the same marketing budget resulting in a superior business case - assuming you own the IP and don’t have to give a cut to the IP holder.

In the case of Battle Royale games though, the top titles are known to attract tens if not hundreds of millions of installs. Because of the scale these games reach, the added value of an IP is questionable.

Now in the case of Call of Duty Mobile, we saw exceptional execution married with the biggest shooter IP in the World. Then there was Final Fantasy VII: The First Soldier where a great IP and a solid execution led to abysmal results. We believe this is large because the audience at large doesn’t associate Final Fantasy with shooters.

In 2022 we will see the launch of two prime EA shooter IPs on mobile. We believe that APEX Legends will succeed as it is already succeeding with the same business model outside mobile. Yet the success of Battlefield Mobile is not a sure shot. Battlefield 2042 had a fantastic first week of sales. Yet looking at the Twitch streams the game doesn’t seem to have the same longevity as a free-to-play title like APEX or COD: Warzone.

Takeaway: Works if the IP has a strong affinity with Shooter players and a free-to-play model to support live services

👎/👍 Sequel to a Battle Royale game

Both PUBG and Free Fire launched sequels in 2021 experiencing drastically different outcomes.

Launching a sequel of a top Battle Royale title with improved production values has also proven to be less than a successful endeavor as both Free Fire and PUBG have noticed. Though it’s not quite as black and white.

In the case of Free Fire Max, launching a high-production version seems like a logical move. We know that Garena has their own expertise penetrating into Emerging Markets. They dominated SEA first and then expanded into LATAM (mainly Brazil and Mexico).

The original Free Fire was developed out of Vietnam for low-end devices. It was a Battle Royale game for those who simply didn’t have the high-end device to play one. Free Fire Max offers the same game with better graphics and thus in theory caters to a new audience in Tier 1 countries. It can also be seen as a defensive move. The original Tier 3 player base has now better hardware and is at risk, in theory, to move to higher production value games.

Garena was successful with its sequel. Revenue grew on average 9% from 67M$ monthly to 73$ monthly. Even though FF-MAX did cannibalize some of FF revenues, the overall revenues increased post-launch but more importantly, there was a strong impact on downloads that grew +40% on average with over 30% total installs coming from FFMAX

The sequel hasn’t given perhaps as big of a boost to revenues as expected. But we can see the total share slowly growing despite installs gradually decreasing after the big launch. This speaks of the longevity of the sequal.

Launching a sequel provided a massive permanent boost to downloads. Please keep in mind that most games declined in H2 as IDFA was being enforced on iOS.

In the case of PUBG: New State, the reason for launching a sequel is Krafton’s attempt to take control over the mobile revenues, which are currently at large part going to Tencent, who has developed and published PUG: Mobile. This attempt seems to have fallen flat after Krafton’s PUBG popped and dropped. Activision needs to learn from what happened to Krafton as they are also planning to release an internally developed Call of Duty mobile game to compete against the hit developed and operated by Tencent.

To conclude: the sequel strategy works, as long as you have control over the prequel.

👌 Product Evolution

Extraction shooters, inspired to some extent by the success of PC-game Escape from Tarko, seem to be the next wave on mobile. There are several ones in development and few of them have launched. Yet the genre defining one is still missing, as the ones early to market lack the accessiblity and the IP to take over.

The evolution of the Battle Royale genre is skewing towards extraction gameplay, where players enter the level to collect loot and get out before they are killed. What makes these extraction shooters exciting is that if the player is killed, they will not only lose all the loot they’ve collected but also all the equipment they’ve on them when entering the level.

Extraction shooters, popularized by the Twitch mega-hit Escape from Tarkov, offer in theory stronger monetization mechanics due to a much more impactful lose-state, which reduces players’ collection. Players are incentivized to craft increasingly more powerful equipment to avoid being taken down in the levels. And while there’s no pay-to-win, spending money on slightly better equipment or ensuring that equipment from others is money well spent. (read more: What Comes After Battle Royale).

The ones to watch in the space are Tencent, NetEase and, Bytedance. All three of the publishers are aggressively trying new takes in the shooter genre with cross-platform titles like Life After, Lost Light, Badlanders.

Takeaway: The decline in downloads indicates the saturation of the Battle Royale genre. The key to success is applying product evolution that will lure underserved audience(s) to the new game. Bundle that with a strong IP and you are looking at the next Billion Dollar shooter game.

Last Year’s Shooter Predictions - We got 5 / 6 right

#1 Free Fire will be a Top 3 Shooter for 2021

Correct! Excluding Chinese, Japanese and Korean markets, Free Fire is the biggest mobile shooter game.

#2 More Multiplayer Shooter games will introduce new progression verticals to drive RPI Growth

Correct! PUBG Mobile’s PvPvE mode is a great example. The game drops squads into an entirely new area and tasks them with scavenging materials worth Metro Cash back in the lobby. Cash earned can be exchanged for guns, attachments, and interesting new ammunition types. Other player squads can steal your stuff as you attempt to loot the map. With equipment lost on death, making subsequent runs even harder, the stakes are always high.

#3 Apex Legends, when it launches on mobile, will not crack the Top 4 in Shooters

Miss! APEX Legends is yet to enter the mobile markets indicating that the early numbers weren’t up to par.

#4 COD Mobile will reach over $900M in Net Revenue Lifetime by the end of 2021

Correct! CoD: Mobile has crossed Billion Dollars in life-time revenues following the launch in the Chinese market.

#5 Vehicular Shooter and Snipers will remain the smallest shooter markets

Correct! These categories can’t compete against Battle Royale and Multiplayer Shooters. An easy prediction to make.

#6 New entrants with a focus on progression will find blue spots in the red ocean

Correct! Titles like Life After, Lost Light, Badlanders are all focusing on manageable power progression to beat games with purely cosmetic progression in unit economics. None of these have yet found their audience though.

2022 Predictions for Shooters

Downloads will continue to decline while revenues will continue going up. We don’t expect a new wave of shooters to hit the mobile market in 2022. Rather it will be a year of quiet dominance from Free Fire, Call of Duty and, PUBG Mobile.

APEX Legends will hit the market but won’t disrupt the top three in the genre.

Battlefield will struggle to find its place in the market. Based on early gameplay, the game looks way off to make a mobile debut in 2022. Perhaps they need more time in the oven. After all, this is the second-largest shooter franchise in the world. The expectations are extremely high.

Chinese publishers will continue to miss with their shooter iterations for Western markets. While the 4X games coming from China seem to be on an endless streak, the shooter developed in China just don’t quite have the shooter core we westerners have learned to expect. The high production values are not enough to cover the poor UX.

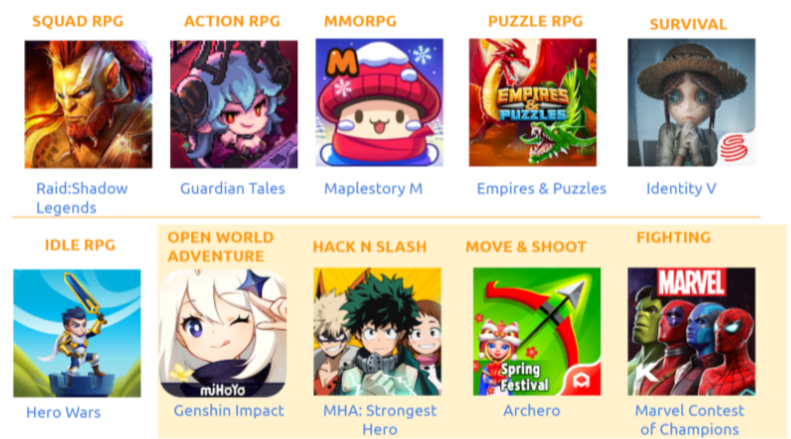

RPGs

RPGs are divided into 8 sub-genres in the taxonomy. Squad and RPGs are by far the largest ones outside key China, Japan, and Korea. The high revenue of MMORPGs you see in the taxonomy is primarily because we didn’t exclude Taiwan from the data pull. Something that we will do in the future as it distorts the analysis.

The RPG genre is the backbone of the mid-core games and consistently growing every year as the second biggest genre in the mid-core category. In 2021, RPG games grew by 7% and reached $4.7B in revenues (Excluding China, South Korea, and Japan).

In terms of publisher revenues, there is a declining trend in every publisher except Aristocrat (thanks to Raid Shadow Legends’ tremendous performance). Additionally, there are 2 new entries to the Top 10 rankings by pushing out Tencent and Lilith Games from the list.

The most notable entry is 37Games, the Chinese developer claimed the top position with Puzzles & Survival and Puzzles & Conquest within the short time frame. The publisher has many Puzzle RPG and ARPG games with above $10M yearly run-rate. Though one could argue that these games could equally fit the 4X genre due to their empire-building metagame. And after reading our 4X analysis you already know that Chinese developers don’t miss in the 4X genre.

37Games, Aristocrat (Plarium) and NC Soft grew while everyone else in the top declined.

Squad RPGs:

Squad RPG games make up one of the biggest sub-genres on mobile in terms of revenues. And it's no wonder these titles monetize so well. They are accessible through a compelling setting, automated gameplay, an endless stream of rewards the player receives during the first week of gameplay. Most importantly, though, collecting teams of heroes leads to an incredible spending depth.

The Seven Deadly Sins, Raid: Shadow Legends, and Marvel Strikeforce were the 3 top growers in the Western markets in 2020. Although Squad RPG is still the most prominent sub-genre in RPGs, the growth was minimal, with only 3%. Meanwhile, the downloads dropped by 20%, similar to all other RPG sub-genres. But nevertheless, Squad RPGs have one of the highest RPDs in the market after just 4X and Slots. High RPD mitigated the impact on the revenues in the long run.

Raid Shadow Legends was the absolute winner this year. Looking at the top 10, apart from Raid Shadow Legends, all games had a declining revenue in 2021. On top of increasing their revenues by 27%, they forefronted cross-platform availability within the sub-genre. They released the game on PC & Mac with Plarium Play, a free service where players can access different Plarium titles. It is difficult to estimate the revenue uplift from these platforms, but we can clearly see that new platforms had no cannibalization effect on the mobile revenues and Raid Shadow Legends continues to grow consistently every month.

Plarium’s RAID was among the first ones to launch outside mobile. Despite the move that most likely increased their net revenues, RAID continued to outperform on mobile as well growing 27% while the competition declined. Plarium showed that cross-platform is a source of overall game growth. Not just the growth of margins.

Unfortunately, key franchises like Marvel Strike Force, Summoners Wars, Star Wars Galaxy of Heroes, 7 Deadly Sins, and AFK Arena failed to sustain the revenues. In addition to that, there were no new releases that made a significant impact like the previous year (7 Deadly Sins and Final Fantasy: BE) which resulted in stagnant revenues.

MMORPGs

MMORPG games struggled many years in Western markets in replicating the success in Asia. In the past, Lineage and Runescapes have entered the market but failed to gain meaningful traction in the West. On the other hand, Black Desert had a fantastic launch and did 25% of its revenue in the US, leaps, and bounds more than Lineage. Unfortunately, as the years progressed, the Black Desert declined rapidly month after month.

In 2021, there was finally a breakthrough in the market. MMORPG games reached $1.1B revenues with 16% growth and became the second biggest sub-genre. This growth was driven by the launch of several new games, but overall the number is misleading. Over 80% of the revenue is coming from Taiwan distorting the analysis. MMORPGs are still no more than a curiosity in the Western markets where if the biggest Asian MMOs fail to gain any meaningful traction.

Puzzle RPGs

The puzzle RPG subgenre has been dominated by 2 strong contestants over the last years, Empires and Puzzles and Dragon Ball Dokkan Battle. While these 2 games were making 70% of the revenue, Best Fiends, one of the oldest titles in the sub-genre continued its modest growth reaching new heights under Playtika’s ownership. Meanwhile, Legendary was clinging to its share of the pie.

In 2021, Puzzle RPGs continued to grow by 17% and reached $850M but the majority of the growth is from a new hit Puzzles & Survival. This new contestant is a post-apocalyptic hybrid mesh of Puzzle RPG and 4X games. It is one of the most successful implementations of a casual mechanic into a hardcore set, along with Top War, that has a merge core. Although it is debatable whether this game is a Puzzle RPG or 4X, just a few months after the launch, Puzzle & Survival became the top-grossing game in the subgenre.

Another release of the year was Puzzle Combat, Zynga’s follow-up on Puzzle RPGs after the huge success of Empires & Puzzles. After challenging 2 years in soft launch, the game was finally released globally in April 2021. Both games share similar feature sets and gameplay elements (simple base building, collection/training heroes, similar social features, and live events) but Zynga was not able to scale up Puzzle Combat during these last 2 quarters.

After its Ludia acquisition, Jam City announced a new Puzzle RPG with DC universe called DC Heroes & Villains, currently in pre-registration. This game has the potential to become one of the top games in the sub-genre

Idle RPGs

Idle RPGs is the only sub-genre with a single making 50% of the total sub-genre revenues. Hero Wars maintains the tradition this year as well by making $172M, triple of its follower Idle Heroes. There are few new entrants, mainly carbon copies of Hero Wars and AFK Arena from small Chinese developers but none of them managed to surpass even a $10M yearly run-rate.

IDFA

IDFA deprecation was the hottest topic in mobile gaming and RPGs took a big hit too. Installs dropped by 12% to 750M from 845M across all sub-genres with the biggest hit taken by Squad RPGs. Survival games were the top downloaded sub-genre with a corresponding one-third of all RPG installs even though it is the smallest one in terms of revenue. There is almost no change in Survival games comparing YoY, no new entrants or replacements in the Top 10. NetEase increased its publisher share with Identity V and LifeAfter while Last Day on Earth and Raft Survival is still pushing to the top in Western Markets.

Notable New Games of 2021

Cookie Run Kingdom: A Squad RPG based on Cookie Run IP, Cookie Run Kingdom got a big sensation after launching in early 2021. The main cosplay is the auto-batting of teams consisting of 5 cookies. Players can control the timing of the special attacks while normal attacks happen automatically. For the meta and progressions, players need to unlock/upgrade new cookies and put toppings on them (aka equipment) as well as improve some other types of materials.

Another big part of the game is Kingdom Mode as the name suggests. Players can build a town, get new buildings that generate in-game resources, trade, and decorate.

The game increased its popularity with its approachability, wide audience appeal as well as successful marketing campaigns and IP collaborations (i.e Sonic the Hedgehog). Thanks to the art style, fun narrative, and easy to approach features, the audience is female-dominated which is uncommon in the Squad RPG sub-genre.

Puzzles & Survival: Although it is difficult to put this game in a single sub-genre, in essence, Puzzles & Survival is a puzzle-RPG core with 4X-like base building with extensive character progression systems as seen in traditional RPG games. Players can use these characters in battles with Match-3 mechanics (similar to Empires & Puzzles) furthermore build their armies and base supported by 4X mechanics.

Seven Knights 2, Netmarble’s sequel to the original Seven Knights first released in Korea in Q4 2020 and launched globally after 1 year of Korean launch. The biggest addition in Seven Knights 2 is a revamp of turn-based RPG core into something called “cinematic play” that features stunning graphics and AAA experience.

Seven Knights was once a flagship title for Netmarble and was an inspiration to many turn-based and Squad RPGs. Although the game was hugely successful in Asia, it never had good traction in Western markets. It is worth watching if Seven Knights 2 can achieve what its predecessor couldn’t.

Last Year’s RPG predictions were all on the money

#1 - Launching and scaling an RPG game will become even harder

Correct, apart from Raid Shadow Legends, almost every RPG game in Top 20 scaled-down and there were no new entries throughout the year.

#2 - Monetization will go broad instead of deep

Correct, Battle/Season Passes were one of the most adopted systems in RPGs with an 80% adaptation rate.

#3 - Collaboration with IPs will intensify

Correct, there were many examples this year in RPGs showcasing great collaboration with IPs (such as Prince of Persia X AFK Arena or Summoners War X Street Fighter) as new limited-time contents and potential acquisition of new audiences of these IPS.

#4 - RPGs Will Go Cross-Platform

Correct, Some of the notable RPGs (such as Seven Knights 2, 7 Deadly Sins Gran Cross) released PC clients, following the trend after Raid: Shadow Legends.

#5 - Zynga's Puzzle Combat will launch globally

Correct, Puzzle Combat launched globally on April 2021, a few months after our prediction. The game still struggles to scale up and is currently between $1M-$1.5M monthly run rate.

#6 - N3TWORK, LEGENDARY’s publisher is going to be acquired for talent

Correct, N3twork’s tech platform has been acquired by Forte at the end of the year to accelerate the development of blockchain games. With this acquisition, N3twork’s platform team is merging with Forte while the game team is being spun out.

2022 Prediction

#1 IPs are on the rise and will continue to be

RPG is one of the most dominant genres in IP licensing and the games with strong IPs are topping up the charts. But there is no success if you don’t take IP synergies into consideration since not every IP is a fit for an RPG audience. A good example of a bad IP gameplay match is Tom Clancy Squad Elite. A game that was quickly shut down. IPs should support your game’s feature-set and core mechanics.

Suitable IPs should come with a huge roster of characters with stories and lore elements that RPG games can easily integrate. An IP that lacks a deep character roster is doomed to fail.

But maybe the most important reason for paying for an IP is that a good one can provide the game with a steady flow of organic installs and a wider appeal that leads to lower CPI. Both are tremendously important in the post-IDFA ecosystem.

#2 Cross-Platform is going to be a de-facto operating model

Genshin Impact and Raid Shadow Legends were the first titles in mid-core that enabled Cross-Platform play for players’ preferences. This is beneficial because publishers can get rid of 30% commission fees of Apple and Google, cross-promote games in their own services, and be able to showcase the production quality and AAA experience better on PC/Mac and in consoles. Until now, PC clients and cross-platform playing are considered as an addition to standalone mobile launches but starting from 2022, we can expect new launches with more platform availability at the same time.

#3 More sequels will be released than ever before

With several top-grossing RPGs having enjoyed over half a decade on the top, we believe that the developers will be attempting to grow by releasing sequels with the same known name but much-improved production values. The reason for this is that the publisher knows the audience for a sequel. This de-risks projects in the post-IDFA world where finding your expensive RPG audience can be a cost too large to bear.