🎮 Playtika goes from social casino to casual - and that’s not good

In Today’s Email

🚀 We follow up and expand upon the Playtika and social casino-discussion that took part in the latest “This week in games”-podcast by going through the latest earnings reports from Playtika (you can find the link to the podcast below)

On the go? Listen to one of our podcasts from this week, we’ve got

🎧 TWiG #208 - Layoffs, Earnings Reports, FTX Collapse & NFT Royalties Explained

🎧 Kress’s Corner #2 How do gaming Venture Capitalist really work?

Eager to play a new game?

🎮 This week we review Summoners War: Chronicles from Com2Us

✉️ Received this email from a friend? Subscribe here!

Playtika goes from social casino to casual - and that’s not good

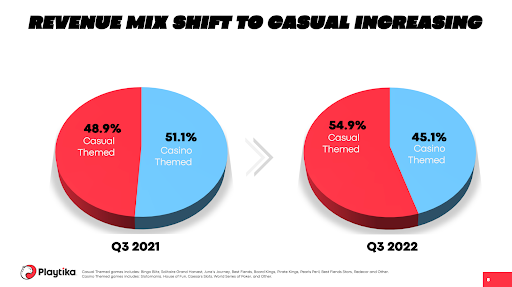

Playtika released their Q3 2022 results last week in which they revealed a shift in portfolio revenue: Over the course of the last year, the gaming company has gone from the majority of revenue coming from social casino towards the majority of revenue now coming from casual game, as can be seen in their earnings release:

Casual portfolio grew revenue 14.4% year-over-year, comprising 54.9% of total revenue

Social Casino portfolio revenue declined 10.2% year-over-year, comprising 45.1% of total revenue (Earnings Release)

In the prepared statements from the publisher, one can read that CEO Robert Antokol states that Playtika takes credit for the great performance they have seen in the casual market: “We saw excellent results from our casual games which grew 14% year-over year. These results demonstrate Playtika’s superior technology, liveOps and ability to optimize and grow revenue over the long term” (Prepared Remarks)

Antokol afterwards addresses the casino business very briefly: “The slot category is a mature, competitive market. Having said that, we are creating exciting roadmaps for 2023 that we expect to provide our players with unique, innovative content.” (Prepared Remarks)

He then hands over to president and CFO Craig Abrahams who says a few words on how Playtika addresses marketing “Turning to marketing, the digital User Acquisition environment continues to evolve and costs per install have increased in the third quarter. As we look out to our plans for 2023, we will continue to increase marketing investment in our growth franchises while being disciplined and data-driven in how we allocate marketing capital.

Our offline marketing campaigns have been a great method to offset this changing UA dynamic to drive user growth and also showcase the brands of our games. We continued to partner with celebrities in the third quarter including Drew Barrymore, Jane Seymour, Dr. Phil and Jay Leno, among others.” (Prepared Remarks)

The statements are very clearly ignoring one big suspect that could have led to this shift, which of course is Apple’s depreciation of IDFA. It is, however, possible that Playtika has addressed the impact of ATT (app tracking transparency) previously, but it is peculiar that it is not mentioned at all now when the casual part of the portfolio has become the majority in this known social casino games expert company.

However, there is somebody who is not ignoring the fact, and that is Eric Seufert who went ahead and shared his opinion in the latest Deconstructor of Fun podcast. Seufert reiterated his prior position that the introduction of Apple’s app tracking transparency policy must have rendered new user acquisition more difficult for Platika.

In the episode, Eric Seufert shared his opinion of the size of the social casino space:

“Fundamentally the problem is that Social Casino is a small group of people. I’ve said this number before and people push back on it, but there is about 100 thousand social casino payers, so everybody is chasing them.”

Seufert goes on and states that there are two major issues with the social casino genre.

Issue #1 The audience is very small. You need to be able to do very targeted advertising, which is severely impacted by ATT.

“You can imagine there are two issues with social casino. You want to have hyper targeted ads to people who have monetized in social casino games before and that requires the kind of Facebook style aggregated data on what games you are engaging with and knowing that this particular user has engaged in social games before, has monetized in social casino games before, and therefore they are a good recipient of a social casino ad. All that is lost with ATT.”

Issue #2 Small audience means you need the ability to retarget and reactive players since finding new ones is very difficult. Re-engagement advertising has also been decimated by ATT.

Seufert afterwards goes on and shared his thoughts on the second problem with working with this small audience, “The other piece is that, big companies, especially with legacy games, a lot of their marketing spend was targeted towards reactivation and retargeting spend. That is just a function of: Well I am going to target the known players from my portfolio, the IDFAs that I know are good players, and not only that, they do not have to necessarily be churned, I am going to target them every time I do an event, even if they are regularly in active in the game, I am going to hit them, because the new event is launching right now, and I know that if I can get them into the app as soon as a new event is launching, then I know that they are good for X amount of money, and there is an arbitrage opportunity there.”

This leads to a pretty tough position to be in for companies in the social casino genre. Seufert ends concludes with:

“Both of those tactics are not possible anymore, so that is why ATT has been so disastrous, especially for social casinos. There is nothing really you can do. “

So why is it bad that Playtika has gone from mainly a social casino publisher to a casual one? Because social casino is and was their cash cow that allowed the company to invest in expanding into adjacent genres. With the social casino business declining that means Playtika is becoming gradually more dependent on genres where they don’t have inherent competitive advantage, such as IPs, and where they have expanded only recently via M&A.

Add a point that Playtika is an outstanding operator but below average at launching new games and you start seeing the challenging position the company is in. Their incredibly well monetizing casino games are declining. Their stock is down. They need the revenue to pay for acquisition of new games, especially since they cannot pay with stock that is declining.

Going forward, Playtika needs firstly to avoid expensive mistakes, such as acquisition for Reworks for up to $600M only to see the game massively decline under new leadership. And secondly they need to get good at launching new games. Something that is inherently the opposite of the company’s core competencies of live operations.

If it succeeds in the points above, we’ll likely hear about the triumphs of the company in the future. If not, it will be a limited acquisition target. Limited, because not every big acquirer wants casino games. And even those who do, would not prefer having declining casino games.

Listen to the full podcast episode discussing Playtika’s struggle (and the FTX collapse) from the link below: TWiG #208 - Layoffs, Earnings Reports & FTX Collapse

🎙️ Deconstructor of Fun Podcast

🎧 TWiG #208 - Layoffs, Earnings Reports, FTX Collapse & NFT Royalties Explained

Ethan and Eric S are in the house to talk about all the dramatic news this week! We're talking about massive layoffs across the tech industry and gaming in particular, new mobile game studios from NetEase and Nintendo, Playtika's latest earnings report, the dramatic and sudden collapse of FTX and the ongoing creator royalty debate going on in the world of NFTs.

🎧 Kress’s Corner #2 How do gaming Venture Capitalist really work?

Kress’s Corner - I sat down with Jason Chapman at Konvoy to discuss how VC’s really work.. How they invest, why they invest and most importantly how much money they make… We also explore how VCs navigate the booms and busts in the business cycle

The Game of the Week

Summoners War: Chronicles (Com2Us)

Com2Us has globally released the next game in their most famous franchise: Summoners War Chronicles. The game is a cross-platform MMORPG and is a prequel to the legendary Summoners War: Sky Arena (two years ago it was reported that the title had broken $2 billion in lifetime revenue [1])

The publisher decided last year to pivot towards NFT and blockchain technology for its games, and this title was supposed to be no different as it was intended to be complete with NFTs at launch (2). However, scanning reviews and the app store descriptions, it seems like this title does not yet have it. Re-pivot or just delay? Time will tell

Weekly highlight by Jesper Gustavsson, Director of Product at SYBO Games

📝 NEWS

📊 INDUSTRY

Unity and ironSource finalise the merger, despite early attempts by AppLovin to scupper the deal

Netflix Announces Gears Of War Live-Action Film And Animated Series

Finnish/Saudi-Arabian trade deal could kickstart further economic collaboration to come

Binance and FTX deal falling apart? Fallout for games and esports

Talking Tom & Friends was the #1 mobile IP of the last ten years

Court dismisses Riot Games' lawsuit against Moonton Technology

Pokémon Go Live Events contributed $300 million to local cities in 2022

Huawei's AppGallery boasts 580m users and promotes lesser-known games at Editor's Choice Awards 2022

Call of Duty: Modern Warfare II tops $1B in 10 days

Japan's PC games market nearly doubled in four years

Overwatch 2 attracted over 35M players in its first month

League of Legends Worlds 2022 peaks at 5.15M viewers

Marvel Snap had a blockbuster release and Clash of Clans saw a 500% increase in daily iOS revenue in October

Huawei AppGallery surpasses 220,000 HMS apps and 580 million user milestones

💻 PUBLISHER

Miniclip rebrand Netherlands based Gamebasic as Miniclip Netherlands amid further expansion

Take-Two sales: NBA 2K23 sells 5M, GTA and Red Dead are flat

Nintendo and DeNA's new joint venture Nintendo Systems aims to strengthen mobile business

Take-Two's mobile division is now the dominant revenue stream for the company, boosted by Zynga

EA dropping Project CARS

Tencent’s TiMi Studio Is Working on a Monster Hunter Mobile Game With Capcom

Riot Games to no longer publish major titles through Garena in SEA

Anzu will bring in-game ads to Socialpoint’s Dragon City

Kabam lays off around 35 people

💎🙌 INVESTING / M&A

Diablo Immortal China release bolsters Activision Blizzard Q3

Activision Blizzard bookings fall 3% to $1.83B in Q3 Take-Two’s bookings grew 53% to $1.5 billion in September quarter but lowers outlook

NCSoft invests $15M in Mysten Labs for Web3 gaming infrastructure

Square Enix's H1 sales dip to $1.1 billion, but profits up

Everybuddy raises $15M for casual mobile games like Lucky Buddies

Nintendo shaves its Switch console forecast by 10%

Activision Blizzard reveals its third quarter financials, with mobile now accounting for 52% of the gaming giant's net revenue

54.9 percent of Playtika’s revenue now comes from its casual portfolio

Anything World raises $7.5M to assist content creators using AI-based animation

Nexon revenues jump 28% year-over-year

Roblox revenue up 2% as quarterly losses hit $300 million

Web3-based MMO developer wins $10m in new capital

Bandai Namco H1 sales rise above expectations

Unity Q3 revenues are up but losses deepen to $239.6m

East Side Games celebrates a 32 percent year-on-year growth, credit their success to strong IP licensing

Krafton profits up to $171.5 million despite lowest quarter since 2020

👾 NEW GAMES

Creatures of the Deep lets you catch fish and sea monsters while solving a local mystery, out now on iOS

‘Football Manager 2023’ Touch for Apple Arcade and ‘Football Manager 2023’ Mobile Are Out Now

Previously Released as Free to Play, the ‘Stranger Things: Puzzle Tales’ Match-3 RPG Joins the Netflix Games Library

The Excellent ‘OPUS: Echo of Starsong’ Is Coming to iOS on November 17th With Pre-Orders Now Live

A Memoir Blue is an emotional interactive poem about a complicated mother-daughter relationship, out now on iOS

Astar Tatariqus, a brand new strategy gacha RPG from the developers of Alchemist Code, announced for a future Japan release

Towa Tsugai, a new collection gacha RPG from Square Enix, reveals some details and opens up pre-registration for Japanese audiences

Jigsaw Puzzle Villa is out now on iOS following Android launch, letting players solve puzzles to renovate a villa

Summoners War: Chronicles, the latest entry in the popular series, is now available for iOS and Android

Ragnarok Arena is giving away in-game goodies and IRL prizes during pre-registration on iOS and Android

MIR M, the sequel to MIR4 from Wemade, opens pre-registration for the blockchain-based MMORPG

Dear, Ella, a fantasy adventure about reclaiming what you once lost, is out now on Android and iOS

Charlotte's Table, a match-3 puzzler where players run their own restaurant, is out now on mobile

How did you like today’s email?

Deconstructor of Fun Oy, Jääskentie , Espoo, Finland