2020 Predictions #10: Playbook to reach the Top of Sports Games

This analysis is written by UX Reviewer’s Om Tandon and product guy and blog writer Alexandre Macmillan

To make sure you don’t miss all the following prediction posts, please do subscribe to the Deconstructor of Fun newsletter. You can find all of our 2020 predictions here.

Unless otherwise specified, all the data has been provided by the wonderful services of App Annie. Please take the numbers with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

As you’ve noticed from the previous prediction post, we actively refer to the categories, genres and sub-genres. This article in our prediction series will cover the Sports & Racing category. It is made up of four sub-genres - Realistic Sports (such as MADDEN, FIFA, 8 Ball Poll), Arcade Sports (such as Golf Clash, Fishing Clash), Realistic Racing (such as CSR), Arcade Racing (such as Mario Kart). To understand our taxonomy in details, please read this. To understand it at a glance, please look at the image below.

Sports genre grew with nearly every sub-genre up, except Realistic Racing (CSR2 declined 11% and no new games scaled up).

On the surface, both Sports and Racing appear like genres that are growing. In 2019 Sports and Racing combined saw an increase of 17% year over year (YoY) in both downloads and Revenue. Looking at each genres individually, Sports revenue increased by 15% YoY, and Racing revenue increased 21%. Sports download were flat with a 1% YoY, and Racing downloads increased by 29%.

Looking at each sub-genres individually, Sports revenue increased by 15% YoY, and Racing revenue increased 21%. Sports download were flat with a 1% YoY, and Racing downloads increased by 29%.

Racing Games

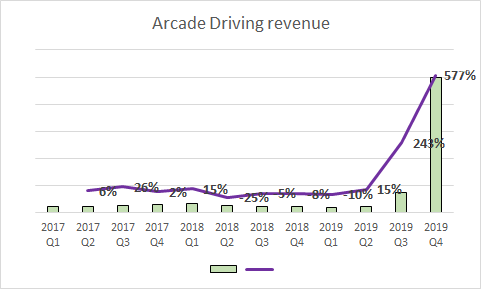

Mario Kart lifted the whole Arcade Racing sub-genre to a massive +520% YoY growth, while Realistic Racing saw it’s fortunes dwindle (-10% YoY) compared to last year.

Sports Games

On the Sports side we see a double digit growth of +15% YoY. While Realistic Sports only registered a +4% revenue growth YoY, Arcade Sports registered a double digit revenue growth of +34%. This uplift is due to Golf Clash, which accounts for more then half of the sub-genres revenue. Two other clashes, Fishing clash and Tennis Clash, also contributed to the growth in a meaningful way.

For both Sports and Racing, the realistic sub-genres generate the most revenue. In large part because the realistic sub-genres are driven by a handful of higher-production-value, IP-based titles. In turn that means developing a new title to break into this category is harder: you need an IP and longer development times to produce a game that can hope to become a contender. Which makes it a riskier bet for potential newcomers - and in turn that helps solidify the position of the current sub-genre leaders. This makes the realistic sub-genres relatively stable categories that don’t see much year over year change.

We would like to highlight 2 key observations as we dive deeper into this analysis:

Both categories (Sports & Racing) are dominated by only a handful of players owning the marketshare and driving the lion’s share of revenue and growth.

Trend suggests that IP/license/Franchises are highly successful in gaining traction and marketshare for companies looking to crack into this category

Realistic sports with an IP has proven to be successful way to conquer and control market share in mobile sports.

Both the Sports and Racing genres are relatively stable categories that have not seen the entry of any significant new player in 2019 (with the notable exception of Mario Kart). There is a structural reason for that - and that’s why that trend is expected to continue in 2020.

For both genres games in the “realistic” sub-category drives the most revenue. Core to the business strategy behind those titles is the desire to leverage the excitement and enthusiasm around an IP (or IPs - in the case of cars) that exist outside the game. Stated differently, both Sports and Racing games monetize in large part off the appeal of those brands/leagues outside of mobile.The success of those games depends in large part on the appeal of the IP on which they are built - and on the game’s ability to deliver to those fans a fun way to engage further with their favorite sport league (or car manufacturers).

“Realistic” IP-based games are usually characterised by a higher production-value (to better reinforce the enthusiasm around the IP). There are also only so many sports league that could generate enough traction in the market. Because of all that, it’s more costly and riskier - therefore less likely - to break into the top games. In both Sports and Racing, the realistic sub-genre (and therefore most of the genre’s revenue) is trusted by a handful of big players. And it’s very difficult for any new comer to become a significant player.

That’s the main reason why Racing and Sports genre are monolithic categories that don’t see many changes year over year. However, the arcade category caters to a more casual userbase - more interested in gameplay than offering an opportunity to engage with franchises and sports/car brands on mobile. That genre also attracts more installs. Because of that, the arcade subcategories tend to be very fragmented sub-genres: they are mostly composed of many low-production value games. That’s also why Mario Kart made such a big splash in the Racing genre, and why that one single game reshaped the entire Arcade Racing sub-genre in 2019.

So, who’s good at sports?

Sports genre (Realistic + Arcade) revenues overall have grown at a marginal rate of +15% YoY, while downloads grew at +13% YoY. Sports is three times larger than racing. Historically it’s the realistic sports sub-genre that has been bringing in the lion’s share of revenue but we can see this gap slowly closing YoY now. The reason for this decreasing revenue gap is the declining Realistic Sports sub-genre, which registered only single digit growth of +4% in 2019 while Arcade sports registered a healthy double digit growth of +34%.

Another trend to notice is, QoQ revenue and downloads for the genre though growth seem to show a fluctuating trend. This could be due to seasonal effect of realistic sports licences (Example: peaking downloads and revenue during FIFA season) or launch of new entrants (Tennis Clash, MLB Tap Sports 2019).

Arcade Sports is booming!

Arcade sports revenue and marketshare for past 2 years has been heavily dominated by one game. Playdemic’s Golf Clash accounted for over half of the sub-genre’s revenue in 2019 (62% YoY).

Clashing has been lucrative in Arcade Sports as several companies copied Golf Clash meta switching the core game.

Golf Clash has been a genre defining game for sports arcade, ever since its launch in 2017. With elements inspired from Clash Royale’s seamless UX/UI, easy to pickup core game play, addictive player vs player competition and intuitive user experience. Golf Clash readily gained popularity on top grossing charts globally leading to studios acquisition by Warner Bros’s TT studios in 2017. Even though wildly successful Golf Clash has been facing steadily rising competition for past few months.

To learn more about Golf Clash’s secret sauce, read the full deconstruction here

Why is Golf Clash losing ground?

Golf Clash’s popularity in arcade sports sub-genre can be gauged from the fact that in Q1 of 2018 Golf Clash held a whopping 85% sports arcade revenue market share. It was unarguably the Machine Zone of arcade sports, however in the past 2 years, 3 games have gradually increased their market share, eating in to Golf Clash’s priced pie (50.32%, Q4 2019). These games include Fishing Clash 2018 (19.22%, Q4 2019), Golf Rival (9.11%, Q4 2019) and the latest entrant in the last quarter of 2019, which is off to a rocket start, Tennis Clash (12.13%, Q4 2019).

Golf Clash declined pretty much all year. The revenues spiked towards end of the year but the decline has continued in Q1 2020.

So, How did this decline come about?

While Golf Clash is still the market leader by a huge margin (62% Market share, 2019). Revenue and downloads graphs above show a steadily declining trend (Discounting the month of December/ Holiday season effect). Decline in revenue for Golf Clash seems to be way more steeper compared to downloads during the same period, which can be attributed to loss of market share to games with similar attributes and direct clones (Fishing Clash, Golf Rival, Tennis Clash).

The graph above for top 4 arcade sports games by market share tells an interesting story, there is a relatively noticeable decline in revenue of Golf Clash as the revenue stream of other key competitors is rising throughout the year! We can infer 2 things from this:

User base in ARCADE sports category may not be as strictly loyal to the games archetype (Golf, Fishing, Tennis) as they are in REALISTIC sports category. It seems that a portion of players plays sports games because they are easy to pickup and offer player vs. player experience. These attributes are shared by all the other top 3 games who have been steadily increasing their revenue and market share, throughout the year.

The arcade pie is growing: Arcade sports sub-genre has registered good growth in terms of both downloads (+13% YoY) and revenue (+34% YoY). The overall size of the market pie has increased due to different sports archetypes mastering the principles of arcade sports and releasing successful products. We believe that the growth of individual titles will not necessarily lead to competition, in-spite of user base overlap, as there is enough room for them to co-exist and grow.

Here’s the good nows: there is significant room for sports games that can offer an engaging and competitive gameplay tied to a real sports. Here are some games that should get greenlit: Tap Hockey, Hunters Clash, Table Tennis Clash, Tap Rugby, Tap Cricket…

The Clash Club

Looking closely at the competitive scene in Arcades Sports, Fishing Clash has been increasing it’s marketshare at a steady pace throughout 2019 while Golf Rival, a direct clone of Golf Clash has also managed to gain a steady foothold stealing a marketshare of around 8%.

Tennis Clash, the latest red hot entrant in to the arcade sports sub-genre was launched in last quarter of 2019 by Brazilian Wild Life studio known for a string of successful hits in the past like Sniper 3D, Colorfy and Color by Numbers, which have been on top downloads and revenue charts worldwide.

Not surprisingly, when launched,Tennis Clash ranked in top 10 most downloaded games in over 100 countries managing to seize an impressive 12.13% of the revenue market share in Q4 2019. Wildlife studio also secured $60 million in funding recently based on its broad portfolio. Nevertheless it still remains to be seen if Tennis Clash has the same longevity as other clashers in the sub-genre. Given what we’ve seen during last few months, there’s nothing that would make us doubt them.

2020 Predictions for Arcade Sports

2020 Prediction #1: Arcade sports sub-genre will see it’s revenue and downloads soar, further in 2020. Revenue gap between realistic and arcade sports will further reduce in 2020.

2020 Prediction #2: Golf Clash will see possibly further erosion of it’s market share, but will still retain its no. 1 position in 2020. We will see more aggressive addition of meta, social features and live-ops events combined with potential franchise tie ups.

2020 Prediction #3: Golf Rival, Fishing Clash and Tennis Clash will continue to grow their market share in 2020.

2020 Prediction #4: More direct or indirect rivals of Golf Clash will appear mastering the recipe of fun arcade game play, easy to pick up core mechanics and intuitive UI/UX to compete for the growing arcade sports marketshare.

Realistic Sports needs a reality check

Realistic Sports sub-genre has remained relatively dormant compared to Arcade Sports. No new chart bursting contenders entered the sub-category, due to reasons mentioned earlier in the article. Revenue grew at a very marginal rate of +4% YoY and downloads declined to -7% YoY. Ageing games launched over 3+ years ago like 8 Ball Pool, Madden NFL and FIFA Soccer still dominate the market share. Only exception being Glu Mobiles MLB Tap Sport 2019, which is a successive version of previous MLB Tap Sports games.

As mentioned previously 4 out of 5 top games by market share in this sub-genre are built around very popular real world sports franchises, MLB, NFL, FIFA and MLB. This genre has strong appeal for sports aficionados. Untapped sports franchise based games could be the key to enter this market in 2020.

A Tale of Two Games

Revenue of key Realistic Sport games.

When it comes to dominating this sub-genre, Miniclip’s 8 Ball Pool and EA’s FIFA soccer seem to be neck to neck, together owning almost 50% of the market share.

Miniclip’s 8 Ball Pool was launched way back in 2010, and has been reigning on top grossing charts for a long time now. 8 Ball Pool arguably has the best pool physics engine that delivers a very satisfying real time turn based pool playing experience. Though the key to its continued success is not just a robust core gameplay engine.

the evolution of 8 Ball Pool

More importantly Miniclip has been incrementally adding new meta, social and chance based features YoY to the game, using genre blending methods. These additions refresh core user experience while creating new monetisation sinks. Example: Addition of decorative pool cues with value added buffs, Clash Royale style mystery boxes, free range betting features borrowed from casino games. You can find the complete 8 Ball Pool deconstruction in this 2 part series here.

Worth mentioning is also the social hub and friends tracking/challenging widget, that keeps track of your friends online, with real time notification and suggestions for initiating matches with new players.

On the down side addition of so many features creates a buffet system though, which can create an overload of features and choice bias for the players in the long run. On the other hand EA’s FIFA Mobile and Madden NFL continue to build on the popularity of successful soccer and American football franchises.

Specially noticeable among these EA games is the vibrant young colour scheme and their uber polished UI/UX, designed to appeal to younger fans of the franchise. This is an important distinction from some of the other older generation football manager games, which look and feel like they were designed for a more matured/older audience.

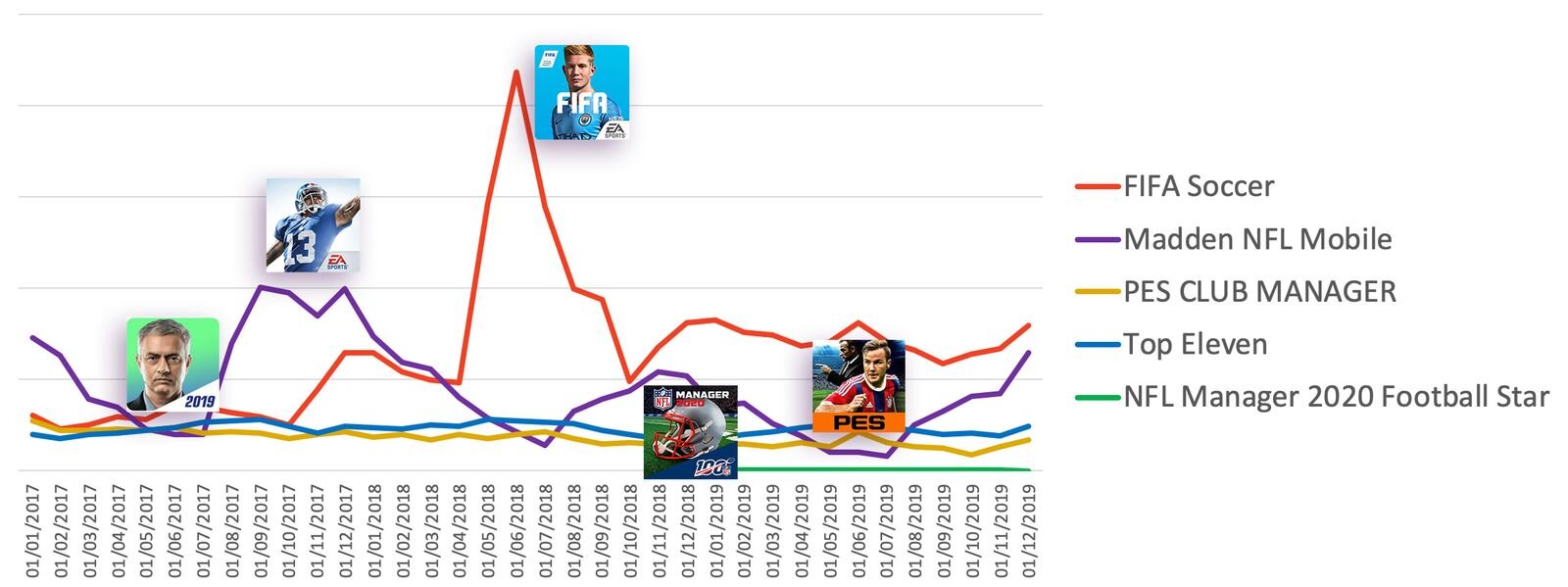

FIFA Soccer’s revenue and downloads seem to have peaked massively between 2nd and 3rd quarter of 2018, no doubt owing to 2018 FIFA World Cup in Russia. Downloads seem to be declining steadily though on a QoQ basis throughout 2019.

Gameplay matters in Realistic Sports games

Most games in this Realistic Sports sub-genre seem to have either pure strategy based gameplay, which involves mainly management of team, resources and training aspects (NFL Manager 2020 Football Star, Top Eleven, PES Club Manager) without any core gameplay element. Gameplay follows fire and forget mechanism, where all decisions regarding the team (training, tactics etc.) are made in advance, and player is just an observer during the actual match or notified when it has happened. (Much like battles in 4X games). PES Club Manger does have some real time tactical control during a match, but they are relatively limited in scope.

Pure strategy based gameplay example: NFL Manager 2020

Or on the other hand we have hybrid games like FIFA Soccer and Madden NFL, which have mixed gameplay elements of both strategy as well as tactical gameplay. These require user input in real time for the game’s outcome.

Mix of strategy and tactical gameplay: FIFA Soccer

Looking at the graph below we can see that games with both strategy and tactical elements seem to be faring much better than just pure strategy based games, it is possible that mobile audiences favour more action oriented gameplay compared to pure resource/team management when it come to this sub-genre. (While market leader 8 Ball is not included here, as it is not a franchise game. 8 Ball’s gameplay leans heavily towards tactical rather then strategy based game play)

2020 Predictions for Realistic Sports

2020 Prediction #1: Realistic sports might see further stagnation in terms of downloads and revenue, unless new games/untapped franchises enter this sub-genre aiding the old guard of ageing games and giving this genre a much needed boost

2020 Prediction #2: While the wheels are slowing down, given the size and fan base of this sub-genre, we believe there is opportunity for untapped sports licences to come in and carve out a lucrative share of the market pie

2020 Prediction #3: Games with a mix of tactical and strategy gameplay elements (FIFA Soccer, Madden NFL) seem to be doing much better then pure strategy based games (NFL Manager, Top Eleven), this will continue to be true in 2020

2020 Prediction #4: If new chart busting franchise games enters this genre in 2020, they will most likely have either purely tactical or a mix of tactical and strategy based gameplay elements

Racing Genre & Sub Genre Details

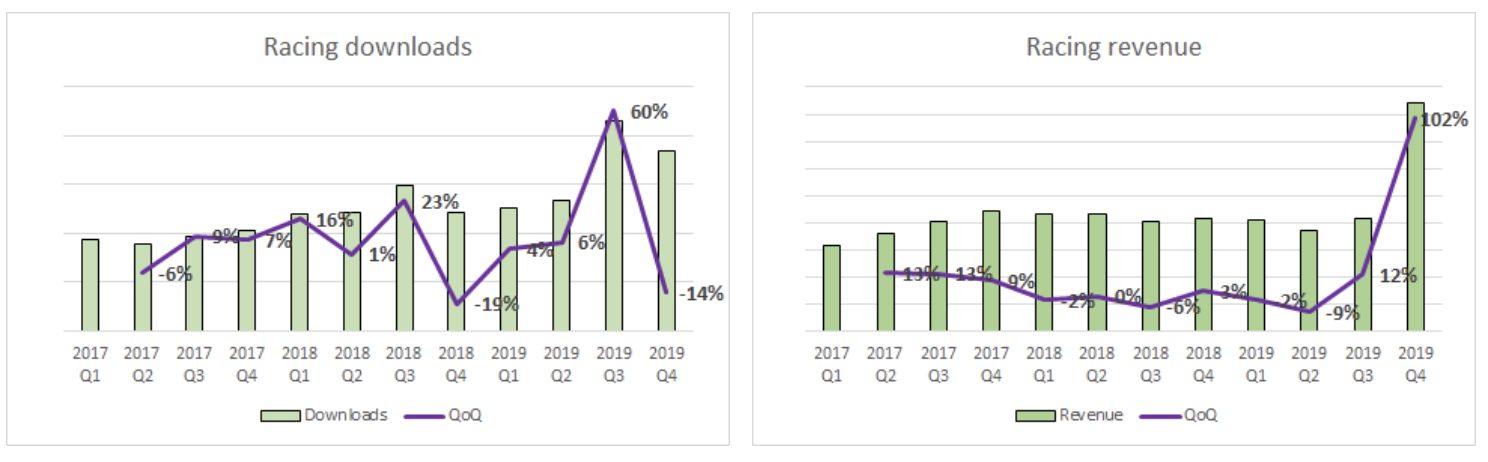

In 2019, Racing downloads have increased by 29%, and racing revenues have increased 21%. If you look at things on a per quarter basis, the trend is even more striking. In Q4 Racing revenues increased by 102% QoQ (it’s the same increase for racing revenue YoY when comparing Q4 2019 to Q4 2018).

However, this does not reflect a change in structural trend for the Racing genre. It rather reflects the impact of a single release in the category: Mario Kart. In 2019 revenue in the Arcade Driving sub-genre increased by over 500%. All because of the release of that one meaningful title (in a very peripheral sub-category).

The impact of Mario Kart in the racing genre in general - and in the racing arcade in particular - masks a bigger (and more concerning) trend for the genre. The entry of Mario Kart masks the fact that as a whole the genre is stagnating - or even decreasing. If you look at the Racing genre as a whole - but this time while removing Mario Kart - there is a 6% increase in downloads (compared to a 29% increase if you include Mario Kart) and a 10% decrease in revenue (compared to a 21% increase if you include Mario Kart). If you look more specifically at the racing arcade sub-category, the contrast is even more striking. Revenue in the sub-genre increased by 520% (+$52M) and downloads increased by 46% (143M installs). But all of that increase is due to Mario Kart. Without Mario Kart, downloads in the sub-genre only increased by 8% (25M installs) and revenue actually decreased by 11% (-$1.1M).

Although overall it would seem like the Racing genre is healthy and growing. The reality is quite different when you remove Mario Kart from the picture. Mario Kart was a significant game in 2019 (although probably less than Nintendo would have hoped for) in a genre that is still struggling to become meaningful in the mobile market. Even with the boost brought by Mario Kart, Racing only accounted for approximately 1% of the mobile market revenue (compared to RPG which accounts for 30%+, or strategy/puzzle that account for 15%).

2020 Predictions: a macro-level view on the Racing genre

Mobile revenues are clearly skewed towards some key genres. in 2019, the top 3 genres in terms of revenue (RPG, Strategy and Puzzle) accounted for 65% of mobile revenue. On the other hand, downloads are much more evenly balanced. Games in the Arcade genre accounted for 36% of total downloads, and Puzzle accounted for 17% of installs. The next biggest genre in terms of install share were Shooter and Lifestyle at 6%. When looking at things in this light, it appears there is potential in the Racing genre, and room for new players in the market. Racing is the genre that generates the least revenue, but has honorable download numbers - 3% when Sports is 2% and Casino slightly above 1%.

More likely than not, the boost to the genre brought by Mario Kart won’t last. The huge increase seen in the Racing genre (and the Arcade sub-genre) in Q4 reflected the release performance of the game. Not only do you have to assume the performance of Mario Kart is below expectations. Only a few months after its release it is already showing signs of loosing traction and momentum. Revenue in December was 50% less than what it was in October, and it doesn’t feel like a stretch to assume the decrease will continue. (listen to our podcast episode on Mario Kart). That’s also why the default trends between Realistic and Arcade will probably get back to normal.

There is a discrepancy between the revenue share and the install share of the racing category. And a in this case it’s a negative discrepancy. For example, RPG games accounted for 3.9% of total installs, but a whopping 30.0% of total revenues. In the case of Racing, we’re looking at 2.8% of installs and 0.7% of revenue (the smallest genre in 2019 in terms of total revenue).

This discrepancy could be due to structural/demographic considerations: perhaps users attracted to the Racing genre might also tend to be more reluctant than other player segments to spend in mobile games. But more likely than not, this discrepancy probably reflects a huge opportunity out there. But as we’ll see below, it’s easier said than done - and there are some structural challenges to the category.

There is a discrepency between the revenue share and the install share of the racing category. And a in this case it’s a negative discrepency. For example, RPG games accounted for 3.9% of total installs, but a whopping 30.0% of total revenues. In the case of Racing, we’re looking at 2.8% of installs and 0.7% of revenue (the smallest genre in 2019 in terms of total revenue).

This discrepancy could be due to structural/demographic considerations: perhaps users attracted to the Racing genre might also tend to be more reluctant than other player segments to spend in mobile games. But more likely than not, this discrepancy probably reflects a huge opportunity out there. But as we’ll see below, it’s easier said than done - and there are some structural challenges to the category.

Arcade Driving is not really driving revenue

The 2 racing sub-genres in racing reflect a quite different reality (and market). There is perhaps also something specific to the Racing genre, which helps explain why we’re not observing the same dynamics in arcade sports and arcade driving. Arcade titles tend to have a stronger emphasis on gameplay. And just like there are many different kinds of sport, there are different types of sports gameplay. Racing on the other hand involves a much more straightforward mechanics. And that can make innovations on that front harder to come by. Ultimately, the big actions around driving are accelerating, steering, and some times shifting gears (as everyone knows, braking in racing games is optional). Because of that, it’s harder for one title to stand out compared to the others. And it feels like any breakthrough in that genre would have to involve some significant creative innovation to be compelling for a large segment of arcade racing fans. Alternatively, it would have to be a game that has enough brand recognition to make it stand out from the mass of other titles available.

The arcade racing sub-category is totally fragmented and composed of many small players. That’s one of the big reasons why Mario Kart was able to account for 85% of the revenue in the sub-category. The multiple followers only account for single-digit percentage (or a fraction of a percentage). In this case, Mario Kart’s success depends much more on the following it draws than the gameplay innovations it brings to the genre.

Just like 2018 or 2017, the Arcade Racing sub-genre is a high-volume/monetisation category. Racing arcade drives much more installs than the realistic sub-genre, but much less revenue. In 2019, 69% of Racing downloads are attributed to Arcade driving, but only 30% of Racing revenue came from this sub-genre. And the contrast was even sharper in 2018 before the release of Mario Kart. In 2018, 61% of Racing installs came from Arcade Driving, but Arcade driving accounted for only 6% of Racing revenue.

The last quarter saw a shift in the revenue distribution between Arcade and Realistic driving. But that’s not a genre/sub-genre shift. It reflects the performance of Mario Kart. And in many respects, the success of Mario is more due to the brand recognition. It hasen’t jumped up in the charts because of the game’s innovative design, meta or monetization strategy. The many limitations of the game have already been pointed out (you can for example listen to the DoF podcast). Considering that (and the current trends observed) it seems unlikely Maro Kart will be an important player in th Racing genre that will grow - either in revenues or downloads.

2020 Predictions for Arcade Driving

2020 Prediction #1: Arcade Driving will continue to drive the most racing downloads, but overall revenue will decrease because of the decrease Mario Kart will see

2020 Prediction #2: Mario Kart will continue to decrease and flatten out. But it will continue to be the top revenue generator in the Arcade Driving sub-genre (because it’s a subcategory that doesn’t monetize - not because Mario Kart performs well)

2020 Prediction #3: The probability a significant newcomer will enter the sub-category is low - and it therefore probably won’t happen. Arcade Racing will continue to be very fragmented and characterised by lower production-value, “hypercasually” titles.

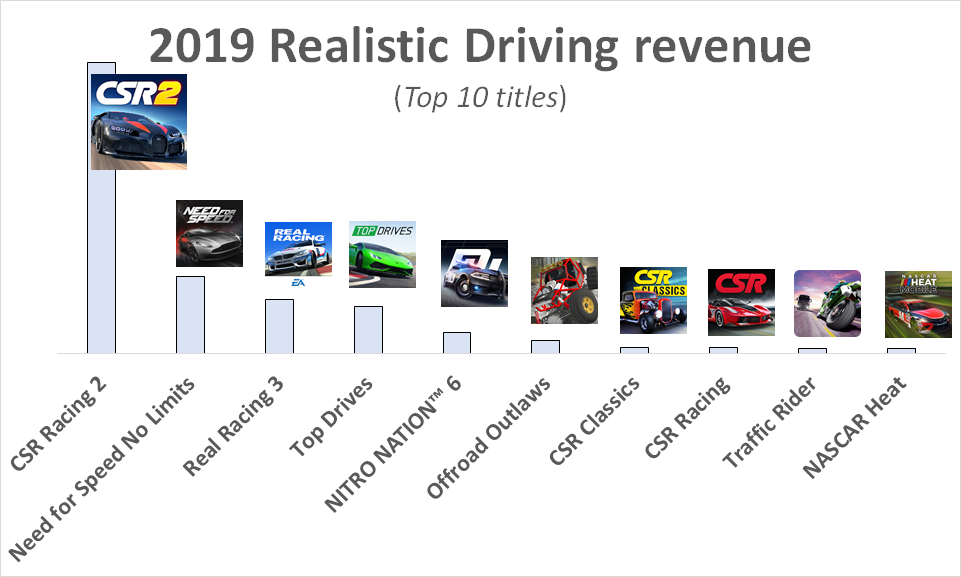

Realistic Driving will continue to keep it real

In 2019, downloads in the Realistic Driving subcategory increased close to 3% while revenues decreased by 10%.

This decrease in revenue is due to the fact that there have not been any significant entries in 2019, and CSR2 - the main leader in the sub-genre has seen a significant decrease in revenues in 2019. In 2019 CSR2 revenues have decreased close to 10% YoY. The impact a single game has had on the entire sub-category reflects how monolithic it is. The realistic racing subgenre is much less fragmented than the arcade sub-genre, but just as static. In 2019 the top 4 games in the sub-genre (CSR2; Need for Speed; Real Racing 3, Top Drives) accounted for 87% of the sub-genre revenue - and those 4 games accounted for 87% of th sub-genre’s revenue in 2018. CSR2 is still driving the sub-genre. In 2019 - just like 2018 - CSR2 accounted for 54% of the revenue of the sub-genre. The fact that CSR Classic and CSR Racing make the list of top 10 games (in terms of revenues) illustrates how little action is going on there - and how difficult it is to release a contender in that space.

Unlike the arcade sub-genre, there have been no significant entries in the realistic sub-category in 2019. The top players - and more specifically CSR2 - continue to dominate (and to a certain extent, define) the market. However, revenue trends have been going downwards for the top 3 games in the subcategory. Top Drive did see some interesting growth, but nothing extraordinary that could change the overall picture.

Titles in the realistic sub-genre tend to be of a higher production-value than games in the arcade driving sub-genre. Having license agreements with a series of different car manufacturers also seems to be a must. Because of all that, building a title that can become a major player in the Realistic driving sub-genre is a costly endeavor (and by extension riskier). That explains in large part why there are so few newcomers, and why little is expected to change in 2020

2020 Predictions for Realistic Driving

2020 Prediction #1: The top 4 titles in the sub-genre will continue to drive the lion’s share of the revenue in 2020. CSR2 will continue t dominate the category.

2020 Prediction #2: CSR2 revenue will continue to gradually decrease, and the following 3 titles will stabilize at similar revenue levels in 2020 as 2019

2020 Prediction #3: There will be no significant entry in 2020. Because of high development time and costs, and considering the fact that there is no major game in soft launch as of the writing of this prediction, it seems unlikely a title will be released in 2020 with the level of production value that is required to break through in the sub-genre. As a consequence, overall revenue in the sub-genre will continue to decrease in 2020.

Recapping 2020 predictions for Sports & Racing

Arcade Sports

2020 Prediction #1: Arcade sports sub-genre will see it’s revenue and downloads soar, further in 2020. Revenue gap between realistic and arcade sports will further reduce in 2020.

2020 Prediction #2: Golf Clash will see possibly further erosion of it’s market share, but will still retain it’s no. 1 position in 2020. We will see more aggressive addition of meta, social features and live-ops events combined with potential franchise tie ups.

2020 Prediction #3: Golf Rival, Fishing Clash and Tennis Clash will continue to grow their market share in 2020.

2020 Prediction #4: More direct or indirect rivals of Golf Clash will appear mastering the recipe of fun arcade game play, easy to pick up core mechanics and intuitive UI/UX to compete for the growing arcade sports marketshare.

Realistic Sports

2020 Prediction #1: Realistic sports might continue seeing further stagnation in terms of downloads and revenue, unless new games/untapped franchises enter this sub-genre aiding the old guard of ageing games and giving this genre a much needed boost

2020 Prediction #2: While the wheels are slowing down, given the size and fan base of this sub-genre, we believe there is opportunity for untapped sports licences to come in and carve out a lucrative share of the market pie

2020 Prediction #3: Games with a mix of tactical and strategy gameplay elements (FIFA Soccer, Madden NFL) seem to be doing much better then pure strategy based games (NFL Manager, Top Eleven), this will continue to be true in 2020

2020 Prediction #4: If new chart busting franchise games enters this genre in 2020, they will most likely have either purely tactical or a mix of tactical and strategy based gameplay elements

Arcade Driving

2020 Prediction #1: Arcade Driving will continue to drive the most racing downloads, but overall revenue will decrease because of the decrease Mario Kart will see

2020 Prediction #2: Mario Kart will continue to decrease and flatten out. But it will continue to be the top revenue generator in the Arcade Driving sub-genre (because it’s a subcategory that doesn’t monetize - not because Mario Kart performs well)

2020 Prediction #3: The probability a significant newcomer will enter the sub-category is low - and it therefore probably won’t happen. Arcade Racing will continue to be very fragmented and characterized by lower production-value, “hypercasually” titles.

Realistic Driving

2020 Prediction #1: The top 4 titles in the sub-genre will continue to drive the lion’s share of the revenue in 2020. CSR2 will continue to dominate the category.

2020 Prediction #2: CSR2 revenue will continue to gradually decrease, and the following 3 titles will stabilize at similar revenue levels in 2020 as 2019

2020 Prediction #3: There will be no significant entry in 2020. Because of high development time and costs, and considering the fact that there is no major game in soft launch as of the writing of this prediction, it seems unlikely a title will be released in 2020 with the level of production value that is required to break through in the sub-genre. As a consequence, overall revenue in the sub-genre will continue to decrease in 2020.