2020 Predictions #9: Newcomers Will Reimagine Card Battlers

To make sure you don’t miss all the following prediction posts, please do subscribe to Deconstructor of Fun’s powerful newsletter. You can find the previous predictions here.

Unless otherwise specified, all the data has been provided by the wonderful services of App Annie. Please take the numbers with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

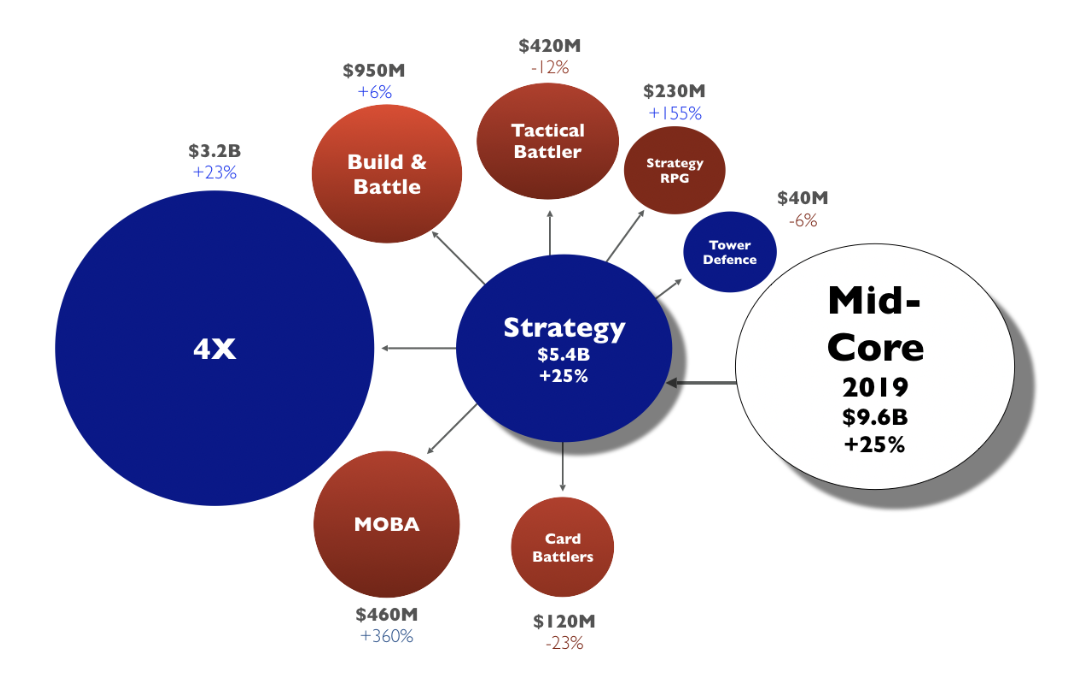

Card Battlers represent only a tiny portion of Strategy Games in the Western market. Keep in mind that we’ve excluded games that generate majority of the revenues from Asian markets. At the moment, Yu-Gi-Oh is not represented in the bubble.

2019 was a poor year for card battlers. The genre declined 23% in revenue vs. 2018, mostly due to Hearthstone being down. The genre is in quiet decline in the West. Hearthstone - the leader of the category since it’s 2014 launch - fell 32% on mobile, struggling to retain players with the same old ranked ladder and struggling to monetize players with new game modes. Much of the excitement in card battlers is in Auto Chess variants, but we carved that analysis out separately - you can read it here (read: Riot's Runeterra Declares War Against Blizzard's Hearthstone). We’ll discuss our old card battler predictions, our new predictions, new card games, and the state of card battlers in 2020 prediction below.

Hearthstone lost on its home turf

Hearthstone is no longer the biggest mobile card game in the US - it has been passed by Yu-Gi-Oh! Duel Links. Neither Yu-Gi-Oh nor Hearthstone focus on North America - Hearthstone is disproportionately focused on China, and Yu-Gi-Oh is even more focused on Japan - but it is notable for Western developers that a Japanese game and art style has snuck up on the American audience.

Both Yu-Gi-Oh and Hearthstone generate roughly the same revenues annually. You can see from the graph that Yu-Gi-Oh is already ahead of Hearthstone in the US. One wonders when Yu-Gi-Oh will enter China…

Hearthstone’s 2019 revenue was down 32% from 2018. Hearthstone’s revenue has always been driven by new content releases, but the most recent content hasn’t been monetizing as well as the 2018 content. Hearthstone players aren’t as voracious for new cards, and there aren’t as many Hearthstone players as there used to be. Hearthstone’s recent sets have also caused balance problems for the game, and in the time it takes to adjust, players churn at higher rates.

Since late 2018, Hearthstone’s revenue peaks from new content releases have been consecutively lower and lower with the latest auto-chess inspired update really underperforming.

Hearthstone has tried to retain players by adding new game modes, but those game modes don’t incentivize players to collect more cards, so the modes at best only retain players, while failing monetize . But, retained players only need to collect one deck to play Hearthstone’s main ranked mode. Hearthstone needs to find more ways to encourage its players to collect more cards and build more decks - or it needs to find a way to monetize Hearthstone Battlegrounds, which is the recently released auto chess mode in the game. Any new game modes Hearthstone launches need to be focused on increasing collection.

To understand more about what Hearthstone could do, to improve the performance of its auto-chess element, please read our analysis on Why Auto-Chess Games can't Monetize - and How to Fix That.

Magic’s been crushing the physical card battler space since 1993, but digital Magic never made much of a splash until MTG Arena launched in late 2018. Comparing Magic, Hearthstone, and Yu-Gi-Oh is tricky because they’re all on PC, Hearthstone doesn’t have a physical game, Magic doesn’t have a mobile game, and Yu-Gi-Oh has both - except Duel Links has different rules from the physical Yu-Gi-Oh game. And, since Magic’s not on mobile, AppAnnie can’t see into their revenues.

Still. Magic is trying to establish itself as a premier esport, so we can look to Twitch to gauge Magic’s success in that arena:

From sullygnome.com, daily average viewers for Hearthstone and MTG on Twitch. On most days, Hearthstone has two or three times the viewership of MTG.

Day to day, Hearthstone is crushing MTG Arena on Twitch. Hearthstone’s biggest spike in late April 2019 coincides with Hearthstone’s World Championship tournament, but their next two biggest spikes are content release days, suggesting that a substantial amount of Hearthstone’s Twitch engagement is organic and not related to esports. In contrast, all of MTG Arena’s Twitch traffic is driven by their Mythic Championship tournaments - Arena drives very little Twitch traffic when they’re not running a huge tournament.

Riot has announced that their new card battler, Legends of Runeterra, will have another beta in early Q1 before coming to mobile sometime later in 2020. We wrote a whole piece about the challenges Runeterra might face, and we’ll get to Runeterra in our predictions below.

In December, Elder Scrolls: Legends announced that it was putting “new content development or releases on hold for the foreseeable future”. This was not much of a surprise - Elder Scrolls has not made much revenue, and the game has bounced from developer to developer.

The failure of Elder Scrolls is a good reminder to folks considering their own card battlers:

The card battler space is quite mature, and declining.

Acquiring players in a mature market is expensive.

Card battlers are very complex by nature, which hurts early retention.

Elder Scrolls, Gwent, and Plants vs Zombies have all failed with the pitch of ‘this game is like Hearthstone, but it is more skill intensive’

A single ranked ladder is poor at monetizing players. Having just a ranked ladder breaks rules 1 and 2 of designing a strong gacha. More game modes are necessary to drive more monetization.

So that’s the state of the world for the end of 2019. Let’s look back at our predictions:

Reviewing our 2019 Predictions

The mobile launch of “MTG: Arena” will majorly shake up the currently stable card battler market, leading to “Hearthstone” and “Yu-Gi-Oh!” both losing market share.

“MTG: Arena” will surpass “Hearthstone” in terms of users, viewers and revenue, while growing the card battler market.

We predicted Magic would launch MTG Arena on mobile and threaten both Hearthstone and Yu-Gi-Oh. We were way off - MTG Arena hasn’t even been announced for mobile, although Hasbro did put a mockup of MTG Arena on a phone in one of their quarterly reports this year. Hasbro also has their new mobile game Spellslingers in soft launch, so it seems likely you’ll be able to play some sort of Magic game on your phone in 2020.

We then predicted that, after MTG Arena came to mobile, it would pass Hearthstone on every metric. It’s safe to assume that Hearthstone has more revenue, more installs and a larger active player base than MTG Arena, since Hearthstone is on mobile and MTG Arena isn’t. Hearthstone did lose market share in 2019, but it’s hard to credit that loss to Yu-Gi-Oh or MTG Arena - Hearthstone is having a hard time retaining and monetizing its players because Hearthstone does very little live ops and has minimal social features, not because of competition.

Valve’s “Artifact” will suffer from lack of mass mobile adoption, unless it responds to the massive community outcry.

This prediction was correct. Artifact failed spectacularly and never made it to a mobile launch. Artifact was too complex a game for most players to enjoy, and no one played it for very long.

We also missed that Auto Chess would rise to its heights of popularity - no surprise, since the genre didn’t exist until early 2019. To make up for what we missed, please do read our auto-chess prediction: Why Auto-Chess Games can't Monetize - and How to Fix That.

2020 PREDICTIONS

2020 card battler revenue will drop 10% from 2019.

Hearthstone will decline another $30M if it keeps its 2019 trend. The question for the space is if Yu-Gi-Oh growth plus new entrants - particularly Legends of Runeterra and a mobile Magic game - can carry that revenue for the category. We don’t think so, at least on mobile. The newcomers won’t launch on mobile until later in the year, and they’d have to be immediate hits to drive these kinds of numbers. It’ll be close, but we expect the category to fall 5-10%.

Hearthstone will decline another 30% in 2020.

Hearthstone will continue its decline in 2020, as neither missions nor Battlegrounds are likely going to drive meaningful revenue growth.

Runeterra will make under $15M on mobile in 2020.

Runeterra’s monetization is heavily cosmetics-based, which won’t be as attractive for mobile players. Runeterra’s second alpha phase did poorly based on Twitch traffic. Runeterra does have a huge cross-promotion opportunity from League of Legends, but most of those players will try Runeterra on PC, not on mobile, since they’ll be coming from League’s PC client. And again, Runeterra won’t even launch on mobile until later in the year.

(note: we reserve the right to call this prediction a win if Riot crosses the $15M mark by lifting their monetization caps on card content)

Yu-Gi-Oh will lead the mobile card battlers in 2020.

This is the prediction we have the strongest confidence in. Yu-Gi-Oh is ascendant while the rest of the category is diminishing, and we’re expecting them to continue their growth into 2020. Even if Yu-Gi-Oh’s 2020 is flat, Hearthstone’s decline should put Yu-Gi-Oh solidly on top of the card battlers.

Card Battlers will be reimagined by the newcomers

The throughline of these predictions is this: Newcomers will have to reimagine the card battler genre to succeed. Several new card battlers are coming to mobile in 2020 - Runeterra, Gwent, Magic, and probably more. All of them are taking many cues from Hearthstone in terms of features, but none will find Hearthstone’s feature list sufficient to succeed. Neither is Hearthstone finding success with their current approach.

Given Hearthstone’s monetization challenges, newcomers shouldn’t copy Hearthstone’s monetization systems. They’ll need to create their own monetization path to drive to the top of the charts. Successful newcomers need to focus on collection and promote mastery beyond a simple ranked ladder system. Launching with a feature set similar to Hearthstone circa 2016 simply won’t do for 2020.