Game and UA Teams That Work Together, Grow Together

Nebojsa Radovic

This post is written by Nebojsa “Nebo” Radovic, who’s an experienced mobile marketing professional who currently heading the user acquisition for N3TWORK’s Scale Platform. Prior to that he worked in product and performance market at Nordeus and Machine Zone.

In the last few articles, Nebo wrote about recent changes in the User Acquisition (UA) space and what is their impact on how we distribute apps, define ROAS targets and, finally set up and automate creative production. This article is the last and, the most important piece of the “scaling” puzzle focusing on the nothing less than the game that is being promoted and the teams that are promoting it.

Breaking into the Top 50 Grossing

If you look at the top 50 grossing charts, you’ll notice that all apps can be broken down in 3 categories:

First movers (Candy Crush, Clash of Clans) — 4%

Cultural Phenomenons (Pokemon Go, Fortnite, Roblox) — 6%

Apps scaled with aggressive user acquisition efforts (pretty much all other apps) — 90%

The reason why the last category is the most populated is that user acquisition is the only strategy for scaling that can be (somewhat) easily replicated. Becoming the first mover is not something you can replicate on the existing platforms in 2020. Hoping that your game is going to become a cultural phenomenon is a super long shot and often requires access to a top IP that can be very expensive.

This is the main reason why mobile game businesses are extremely dependent on User Acquisition (UA), and mastering UA is crucial in building a highly scaled mobile app business.

However, if you’ve been following industry news in the last few years you probably noticed that User Acquisition changed quite a bit. Doing user acquisition is easier than ever due to Facebook and Google leveling the playing field with their new sophisticated optimization models. This puts more emphasis on product and creative than media buying itself.

Creative is not enough

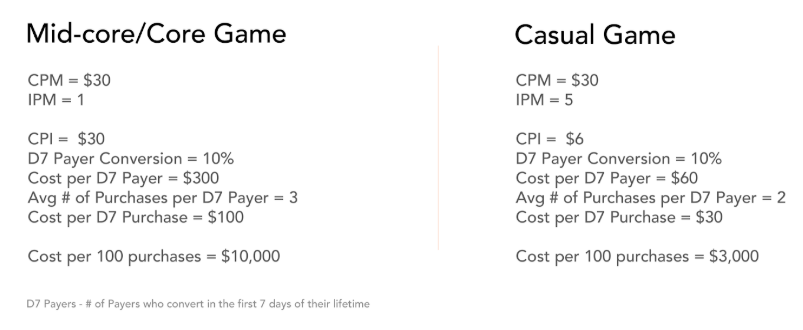

Creative is indeed more important than ever, but… creative on its own is not enough. While IPM (installs per 1000 impressions), as a metric, is crucial for hypercasual games, for mid-core/core apps it’s just the first half of the equation.

IPM measures how well your campaigns stands out and the performance of your store front. But be careful. Sometimes you can get too creative for your game ending up attracting effectively players who are not actually interested in your game.

The key to success is balancing IPM and LTV, and making sure that the gains on the IPM side are higher than the losses on the LTV side of the equation. This is why misleading ads are somewhat less misleading outside of the casual genre. Looking from this perspective, we could even say that the infamous MZ playable is a misleading ad, even though it’s nothing compared to the ads we are seeing for Playrix’ titles or Lily’s Garden.

More importantly, this is why the mid-core/core genres declined in the last few years and the main reason why it’s necessary for product and UA functions to work closely today.

CPM is the metric of product/market fit

UA is nothing but another winner-take-all market. Since, UA is a set of CPM auctions, CPM ultimately becomes the metric that defines and limits the reach of certain products. The more competitive you are, on the CPM front, the higher is the scale your product can reach.

CPM is a result of the combined effort of creative and product teams.

CPM = CPI x IPM

CPI is D(x) ARPI, where x is the target payback window. The more money you have the longer the payback window you can afford, but this has its limits due to the declining nature of the retention curve.

The more money you have the longer the payback window you can afford, but this has its limits due to the declining nature of the retention curve

In early UA days, CPI was everything mainly because games with high LTV were significantly more competitive in the auction than (more) casual games. As the industry matured and UA became easier and monetization became significantly more lucrative, this changed. If you look at the top-grossing charts from 2016 and today, you’ll get a better understanding of what I am trying to prove:

source: super awesome Sensor Tower

There are significantly more casual games in the top-grossing list today than just four years ago and this is the outcome of IPM getting a more important role in the CPM equation than CPI. This called for a completely new approach to making products as it’s become exponentially harder to promote games with poor IPM.

The importance of Reach for Machine Learning based buying

Another nail in the coffin of low IPM games was the rise of machine learning-based buying that I wrote extensively about in one of the previous articles. The main downside of low-converting games is that it gets quite costly for campaigns to get out of the learning phase. Most optimization models require 50-100 purchase signals in order to get out of the learning phase which means that campaigns that are not spending thousands of dollars a day end up getting stuck in the learning phase forever until they eventually get paused.

Increase in IPM has allowed casual games to take over the market from mid-core games despite having lower LTVs.

The best way to overcome this is to cast a wider net (target more broadly), which means that niche products are at a disadvantage. This is why algorithms prefer games with more signals, meaning more installs and ultimately more purchasers. And why reach, or more precisely total addressable market, plays an important role. Having too narrow of an audience prevents you from scaling your products successfully using ML-based bidding efficiently.

Solution: Product & UA teaming up for success!

Now that we know all this, it’s clear that understanding the impact of these changes on how products are designed and built will be crucial for all mobile-first companies who want to dominate this space in the upcoming years. In this set up, the UA team is involved in the product development process from the beginning and makes sure that the product team understands the current market conditions. This includes things such as:

How Facebook and Google, as the largest UA channels, work and what are the different strategies that they can use to drive installs (optimizing for installs/purchase/ROAS)

How does the quality of users differ between channels/optimization models (Rewarded video users vs Facebook Value Optimization or Google target CPA)

The best way to monetize those users as UA channel mix can have a significant impact on ad revenue CPM (having more FB users in the game helps increase FB Audience Network CPMs)

The impact of creative on retention and monetization

The most popular ad creative themes

Additionally, the UA team needs to understand the in-game systems as they can have a big impact on campaign performance. An example of that would be changing the early monetization to feature more smaller purchases (vs fewer larger ones) to help speed up the learning phase.

In terms of specific steps in how these teams could partner up and work together here are 3 examples that further illustrate how gaming companies could benefit from this set up.

1. Research different game themes and art styles

The first step is researching different game themes in order to find the highest converting concept for a specific game mechanic. In most gaming companies this happens much later in the production schedule, once the art style is already defined and the game is getting closer to soft launch. This phase, also known as marketability test, is used to give teams an idea of what is the ballpark LTV they should hit in order to make this game scalable and, ultimately, successful. The challenge with this phase is that it often happens too late to make significant art style/monetization changes.

Instead, theme explorations should happen much sooner and they could be as simple as setting up a fake app store and testing how different screenshots perform. Ideas for themes can come from anywhere and you can see that with hypercasual developers who keep iterating on the same gameplay or leverage popular social phenomenons. A developer that I find particularly successful at this is Wildlife Studios (previously known as Fun Games For Free). It is one of the best-diversified gaming studios I am aware of. Their portfolio features both casual (Math Learner, Colorfy, Tennis Clash) and slightly more core stuff (Sniper 3D, War Machines, Zooba). In my opinion, the key to their success lies in the fact they are great at finding highly converting themes and turning them into successful games:

Sports — Tennis Clash

Math Problems — Math Learner

Shooting & Violence — Sniper 3D

OCD & Oddly Satisfying — Coloring apps (Colorfy & Color by numbers).

Cute looking art — Zooba

These are some of the most shared themes on social media/messaging apps and it’s no wonder they do well on the UA side.

editors note:

I’ve learned (the hard way) the importance of early theme validation. After experimenting with several different services I found that Geeklab has been by far the most accurate and cost efficient of them all. Geeklab has agreed to offer a free two week trial period to their service for all of our readers. That’s how confident they (and we) are in their platform.

Use this link to get your trial activated and start testing themes!

2. Capitalize on trends

I mentioned how machine learning algorithms seem to be giving advantage to more casual art style as it helps them learn faster and, as a result of that, do better. These tectonic shifts in how UA is done happen every few years and companies who understand them early on will win. The goal of the UA team is to understand them and inform the company road-map/game teams on how that can impact growth opportunities.

A great example of a game that capitalized on current trends is king of hybridcasual genre - Archero. As hypercasual space is getting increasingly competitive and slowly getting taken over by ad networks themselves, developers are trying to become more competitive by pairing accessible themes with well monetizing game systems. Archero is the best example of this. The game looks and feels like a hypercasual game (ensures broad reach and high IPM), but features progression systems from much more complex games (ensures good monetization). According to Sensor Tower, Archero has been the top gaming advertiser on Facebook for almost a year now which further proves my theory that reach is super important if you want to leverage ML-based buying.

3. Don’t stop iterating

UA trends can help you pivot the product in order to improve its odds for success. If you had a chance to play Wildscapes recently you might have noticed that the game now features a new mini-game that mimics the elements from the misleading ads. As misleading ads can have a pretty destructive impact on retention, having less friction between the ad and gameplay experience improves the on-boarding and ensures that the user is retained better. The misleading ad, on the other hand, helps bring the cost down and shorten the payback window.

In the case of the mid-core/core genre, the goal of more accessible ads is not only to lower the cost but broaden the reach as well. As the quality of these users is lower than what’s the case with the core players who were attracted by the original theme, the game team should reconsider how on-boarding is done to accommodate the software for the next wave of users. Hero Wars, a game that is consistently among the top 100 grossing games is a good example of this. They were also one of the first companies to run puzzle ads at scale, that are now used by pretty much every larger advertiser in the space. In the video below you can see how they implemented these ads in the actual gameplay.

Bring together your Product and UA teams

The above mentioned examples perfectly illustrate how UA can have a huge impact on product development and how, when these two teams work together, new growth opportunities are unlocked. In the highly competitive mobile gaming space, the winning teams will be the ones that understand how to pair different UA and product tactics to get the most out of the current market conditions.

Pairing of these two different but highly intertwined functions could happen as early as in the pre-production phase, when a team is choosing the theme or art style, or much later in the game when the monetization is defined by existing growth opportunities, like in case of hypercasual and ad monetization. This is why I believe that the next billion dollar game will come from a team that understands both functions well and is able to execute flawlessly on both fronts. Thus, it is absolutely essential for product teams to start working closely with the UA team, and be fully prepared to jump on the right opportunity once it arises.

To further level up your knowledge about growth we warmly suggest following content found on ironSource’s Level Up blog and podcast.

How game product and UA teams can work better together with Nebojsa Radovic, head of user acquisition for N3TWORK’s Scale Platform.

Growth Loop: Start with UA, not monetization, Yevgeny Peres, VP Growth at ironSource.

Cracking mobile game user acquisition strategy for IAP and ad-driven titles with Tatyana Bogatyreva, Head of User Acquisition at Gram Games.

Combining monetization and marketing in game studios with Jeff Gurian, VP Ad Monetization and Marketing at Kongregate

Our partner ironSource builds technologies that help game developers take their games to the next level. They boast industry’s largest in-app video ad network, a robust mobile ad mediation platform, and a data-driven user acquisition platform. In other words, everything you need for game growth.