Deconstructing Unity

This analysis is written by Tim Smith, a seasoned games strategy and analytics lead. Both Eric Kress and Joseph Kim contributed to making of the analysis.

Unity recently filed its intentions for an initial public offering. There’s lots of interesting information in its filing that sheds light on its financial performance, and raises questions around whether it can maintain rapid growth and also become profitable.

Overview

Unity sells software for developers to create and operate interactive real-time 3-D content. It was founded in 2004, and is the market leader for the creation of video games, with over 50% of the top games being built using Unity.

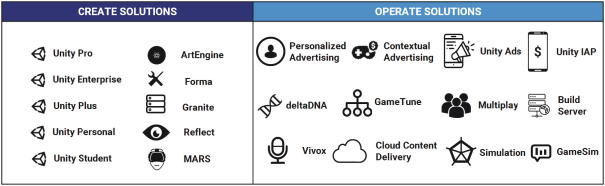

Unity has two sets of products, Create Solutions and Operate Solutions.

Create Solutions are used to develop content. This content can be created once and deployed to more than 20 platforms, including all the main gaming platforms. Revenues come from subscriptions based on the number of software licenses.

Operate Solutions enable Unity’s customers to grow and engage their end users. This includes tools for user acquisition, ads, and various products to increase user engagement and offer specific technical solutions that are useful for gaming companies (e.g. real-time multiplayer). Unity’s revenues are typically a share of the customer’s revenues or based on usage, and so they scale depending on how well their customers’ games are performing. The substantial majority of Operate revenues come from selling ads.

Unity also makes some money from strategic partnerships with hardware, console, and device manufacturers such as Apple, Microsoft, and Sony.

Financial Performance

Unity only provided two full years of financial data so we’re unable to see longer-term financial trends, however it has grown rapidly since 2018. It generated $184M in revenues in Q2 2020, more than double the same quarter two years prior.

While Unity is probably best known for their Create solutions, interestingly Operate solutions makes up 61% of its total revenues, and has powered most of its recent growth. As most of its Operate revenues come from ads, it seems likely that it makes as much or more from its ad network as it makes from content creation.

Unity has made a loss in every quarter, although the size of its losses has decreased recently.

When looking at Unity’s cost structure, we can it has been investing heavily into research & development (46% of revenues in Q2 2020) and sales & marketing (24% of revenues).

Research & development consumes nearly half of revenues. Sales & marketing takes fourth.

So the key questions are, what will be the main drivers of Unity’s future growth, and what are the associated risks?

Growth Opportunities

To understand Unity’s growth opportunities, we can analyze its market using two dimensions — gaming vs non-gaming customers, and existing vs new customers. Note that Unity defines a customer as a single entity, like EA, that might make multiple games. Some of those games might use Unity products, while others might use software from Unity’s competitors.

Essentially, Unity’s growth comes primarily from existing gaming customers, and they have a large potential to grow in non-gaming industries but it is risky and requires heavy investment.

Gaming

The vast majority of Unity’s revenues comes from Gaming customers. Unity estimates that its total addressable market in 2019 was $12Bn, which implies it has a market share of around 5%, suggesting a lot of room to grow. However, it didn’t provide a breakdown of the $12Bn figure, and there are likely several different components to this, some of which Unity might already dominate (e.g. game development), and others where there is strong competition (e.g. advertising). So without further context here it’s hard to know where their biggest opportunities lie and how much of this market it could realistically capture.

Existing Gaming Customers

The majority of its recent growth has come from existing gaming customers. Of its revenue growth from 2018 to 2019, 71% came from existing customers. It has a very high retention rate (99% of customers from a year ago are still customers). Revenues from existing customers have grown by 30–40% a year, and it now has 716 customers generating more than $100k a year, up from 389 in Q1 2018.

We can analyze its potential growth from existing customers by looking separately at Create and Operate solutions.

With Create Solutions, it can grow by persuading customers who make some games with other game engines to switch to Unity. However, this only makes sense for games starting development — it’s very unlikely that a game that’s already live would switch the game engine to Unity (the effort involved in doing so would be prohibitive). Also, gaming today is dominated by games that have been out for several years — of the top 50 grossing iOS games in the US today, only 6 were released in the last 2 years. So studios are focusing more on growing existing games than starting new games, which could limit Unity’s potential for increasing revenues.

Developers starting a new game have to choose between an internal engine (if it exists) or a third party such as Unity or Epic’s Unreal Engine. While Unreal is probably Unity’s main competitor, it is currently going through a very public battle with Apple that briefly looked like it could result in the Unreal Engine losing the ability to support iOS games. While that now seems unlikely following a recent court ruling, developers starting a new game today might be nervous about committing to Unreal until the legal battle has fully played out, which could benefit Unity.

With Operate solutions, growth comes from cross-selling other Unity products. This is where its portfolio of diverse products is a strong advantage — many products are complementary, and existing tools can be used to promote other products. Of its Create solutions revenues that come from customers who spend over $100k a year, only 33% was from customers who also use Operate solutions, suggesting there’s a lot of potential for growth here.

It should also see growth in Operate revenues if its customers’ games grow, as Operate revenues are based on the games’ revenues or usage. This is the easiest way to grow as it requires little additional effort, though obviously revenues could shrink if the games decline.

New Gaming Customers

The other growth opportunity within gaming is to acquire new customers. However, Unity is already the market leader in game engines. It has over 100,000 gaming customers, and 93 of the top 100 game studios by revenues are already Unity customers. So while not every gaming company uses Unity and there are always new studios being created, it seems like it’d be hard to meaningfully grow by attracting new customers.

Non-Gaming Customers

Unity is also trying to grow outside of gaming. It sees a market potential of $17bn (40% larger than the gaming opportunity), and this includes architects, automotive designers, and filmmakers. The use of real-time 3D and augmented reality is emerging in many other industries, and Unity is trying to be well positioned to capture this growth.

It has been able to gain somewhat of a foothold — most of the top 10 architecture, engineering design, and automotive companies by 2019 revenues use Unity. However it has a long way to go — it has only 750 customers outside of gaming (vs over 100,000 in gaming), and only around 57 of those generate more than $100k a year for Unity. Also, the cost of growing outside of gaming is very high — Unity doesn’t have as strong a brand presence, sales cycles are long and intensive, and it needs to invest a lot in sales & marketing to get new customers. So while the potential market could be very big, there’s a lot of uncertainty as to how much it can capture.

Risks

So what are the main risks that might impact Unity’s growth? Alongside typical risks that any company faces, there are three that are particularly relevant.

Firstly, Apple’s forthcoming iOS 14 update restricts the data that advertisers can collect. This is a complicated area with a lot of uncertainty around the potential impact, however it could lead to a meaningful cut in Unity’s revenues. As a comparison, Facebook recently warned that revenues from its Audience Network (ads shown in third party apps) could fall by 50%. Around 60% of Unity’s revenues come from Operate products, so if we take a rough guess and say that 80% of this is ad revenues that could be affected, and that ad revenues fall by 10–50% — that would imply around 5–25% of its total revenues could be at risk. This would obviously be a major problem, especially as the marginal costs for its ad revenues are very low, and so any loss in revenue would increase its overall operating loss by a similar amount.

Secondly, the whole gaming industry has benefited from restrictions related to covid-19, and there’s uncertainty around what will happen once the various shelter-in-place regulations ease, as people might spend less time playing games. This would likely primarily impact Unity’s Operate revenues, and would be most impactful if games companies ended up decreasing their ad spend.

Thirdly, it will need to continue investing heavily in R&D to build products to power growth, especially outside gaming. These are new industries, and they’ll need to invest heavily to build the right products, and to cultivate the leads required to win new business.

Profitability a pipe dream despite market dominance

Overall Unity is in a dominant position in the gaming market and has the potential to continue growing quickly. However, growth outside of gaming is uncertain and will require a high level of sustained investment, and could mean that the company stays unprofitable for a long time. And there’s some short-term risks around the forthcoming iOS 14 update and what happens to the overall gaming market once people’s routines return to normal. However, it is making bold bets that could pay off, and it’ll be fascinating to watch how the stock performs over the next few years.

Please subscribe to the Deconstructor of Fun newsletter for more 🔥 content like this.