2022 Predictions #3 Sports Games Get Beaten from a Pillar to a Post

This prediction is written by Michail Katkoff and members of the Deconstructor of Fun community.

Access all previous predictions here.

This report wouldn’t be possible without the help from our friends at Sensor Tower. An essential data platform for all mobile gaming studios.

In this analysis, data from China, Korea, and Japan are excluded as this analysis focuses on Western markets only. This is because we don’t want to reduce the actionability of the data with games that succeed massively in what can be described as closed domestic markets. Please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise of accuracy.

This prediction post is sponsored by PlayerWON™, the only engagement and monetization platform for free-to-play PC and console games.

PlayerWON provides gamers with opportunities to earn valuable rewards in exchange for choosing to watch TV-quality brand videos – all while driving engagement, retention, lifetime value and additional revenue for developers. Everybody wins! Check out PlayerWON in action and get more info.

Sports & Racing Games in 2021

In 2021 Sports category on mobile hit the wall. Category revenues remained stable at $1.3B while the rest of the market grew by 14%. Downloads for Sports games declined 9% (the rest of the market declined 5%) during the same period of time, which is quite surprising given the broad appeal and relatively easy-to-target audience most sports games have.

In our Taxonomy found on Sensor Tower, we break down Sports into two genres: Sports and Racing. The racing genre is further broken down into Racing Simulators, Kart Racing, Arcade Racing, and Drag Racing. The sports genre is on the other hand broken into Sports Manager, Arcade Sports, and Realistic Sports sub-genres.

The largest revenue drop was experienced by the Racing Simulator and the Kart Racing sub-genres:

The Racing Simulator is a very small sub-genre. EA’s Real Racing represents 70% of the revenues in Racing Simulator. The game experienced a 31% drop sinking to the whole sub-genre with it.

Kart Racing declined due to some reasons. Mario Kart, which stands for a whopping 95% of sub-genre revenues declined by 22% and brought the rest of the sub-genre with it.

In terms of growth, only the Sports Manager sub-genre can boast exceeding the annual growth rate of the rest of the market at 35% year-over-year. The growth was pushed by two of the top titles, Top Eleven, F1 Clash growing and supported by rapid scaling up of Football Rivals and Tetro Bowl.

Sports the Manager sub-genre was also the only one in which downloads grew. Meanwhile, Drag Racing declined a third and Racing Simulator a fifth in terms of downloads. The average market growth rate was +14%.

EA Sport’s falling out of the game

Some franchises held above the water, others declined and a couple games collapsed

2020 was a tough year for EA Sports as its crown jewels NBA and Madden both continued to strugge. We pointed out that this was likely due to real sports struggling under the impact of a pandemic, which delayed seasons. Then there were ‘culture war’ issues, which alienated the audience.

The impressive growth of Need for Speed was wiped out by the decline of Real Racing. FIFA grew a bit boosted by the European Championship games. All other major franchises declined considerably. MLB’s strikeout was the most surprising one as it’s the first time the game declined in its history.

The assumption was that in 2021 NBA and NFL would rebound as the restrictions faded and the somewhat normal seasons could resume after the election of a new president. And as the real sports rebounded, so would EA Sport’s mobile games.

Contrary to our assumptions, EA sport’s portfolio declined 11% in revenues and lost 6% in download.

NBA Live had a significant decline in 2020 only to be dunked on in 2021. The downloads continued to go down, but what happened to the revenue put the whole game in jeopardy. EA will have to make drastic changes in 2022 to save the game from obscurity. (read: deconstruction of EA’s NBA Live)

The decline of downloads has been constant. But the decline of revenue really accelerated in 2020 and 2021. The NBA season in 2020 performed poorly. The 2021 season had better ratings, but for somewhat reason it didn’t reflect in the game’s performance.

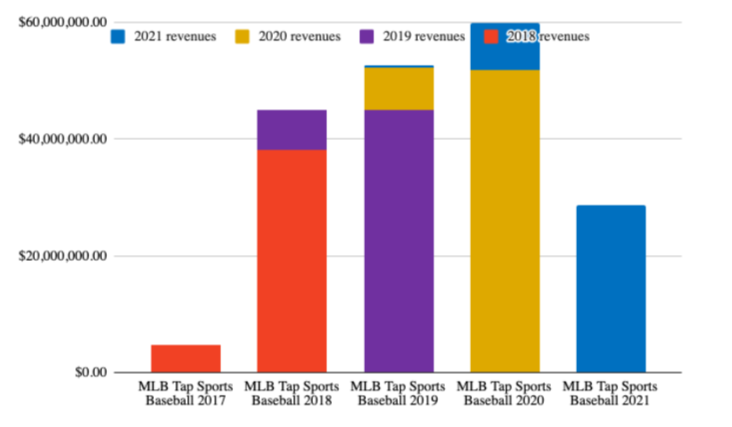

MLB sports fell after EA acquired Glu. The game lost nearly half of the revenues despite showing growth every year prior to 2021. The new sequel of MLB Tap Sports Baseball 2021 released in March last year declined a worrying 38%. Since the game got the usual number of downloads, the suspect for this could probably be the quality of the game itself. It seems obvious that Glu’s Tap Sports team dropped the ball on this game. From the public sources, we know that the leadership, that founded the Tap Sports studio also left last year, which puts the future of this amazing asset into real jeopardy.

Glu’s Tap Sports Baseball game releases annually and replaces the old version quite well. This is different from EA Sport’s strategy on mobile where the game gets reset with each seasons removing the risk of migrating players to another app.Up until 2021, every new game broke the previous revenue record while keeping the similar amount of downloads year over year.

In case you’re wondering, downloads are not to blame for the massive decline. MLB interested players just as much in 2021 as years prior.

And then there’s the interesting case of Madden. Until 2020, Madden on mobile was known as Madden NFL Mobile Football. And it was an impressive title that always found its way into top-grossing charts in the US during the playoffs. In 2020, EA launched Madden NFL 22 Mobile Football, which phased out the previous title. Despite hitting record downloads, during a very challenging NFL season of 2020, the game continued to slide in 2021. The strategy to put the game back on the growth path by launching a new app nevertheless failed.

In 2020 EA launched a new Madden Mobile game to replace the existing one. This resulted in growt of installs but it didn’t stop the decline of the title in 2021.

In addition to declining franchises, EA Sports on mobile has more to be worried about. None of the 6 new mobile titles that EA’s CEO Andrew Wilson announced 15 months ago hit the market. There’s some hope that these new titles can get EA sports back in the game. Though 6 new soccer games do feels quite excessive.

Golf Clash vs. Golf Rivals

What happened to the rivalry after both of the games got acquired by EA and Zynga?

In 2020, Golf Clash, which single-handedly dominated golf games on mobile got challenged by a new direct rival. This new game by the Asian publisher GR Sports Club looked every bit like Golf Clash and was unsurprisingly called Golf Rival.

In the summer of 2021, both games were acquired one after another. Zynga paid $525m for Golf Rivals, while EA $1.4b dished for Golf Clash. So who got the better deal? EA, who purchased a matured title or Zynga that acquired the up-and-coming rival?

In 2021, Golf Clash managed to stay on their 2020 direct revenues target ($122M) despite downloads being nearly cut in half (-46%). This is an impressive feat that speaks for the longevity of the game. On the other side, Golf Rivals had more or less the same amount of downloads YoY but 30% more in direct revenues ($57M).

Given the hefty price paid by EA and the subsequent decline of downloads, we can assume that the earnout for the team is around profitability, not growth. If the trend and presumed incentives are equal, it’s only a matter of couple of years before Golf Rivals passes Golf Clash.

Golf Clash held the same run rate despite downloads being cut in half. Golf Rivals grew revenues without growing downloads. One is clearly optimizing for profitability while the other one is going for measured growth. It’s only a matter of a couple of years before Golf Rivals passes Golf Clash.

Besides the two dominating games in golf, a game definitely worth mentioning is Miniclip’s Ultimate Golf. It’s the second Miniclip’s golf title besides Golf Battle. The game managed to over triple their revenues in 202, and it is now the third largest in golf game in the market with a tremendous growth rate. The main differentiator for the title is the more mature feeling setting. The gameplay is almost identical as in Golf Clash or Golf Rivals but graphics seem less cartoony and much more ‘adult’.

The overall golf pie is growing. Golf Clash is losing its market share by not growing with the market. Miniclip’s second attempt the golf game is paying off with a rapid growth.

Racing Games

CSR2’s silent dominance, Mario Kart’s rapid decline and special shoutouts to few killer games

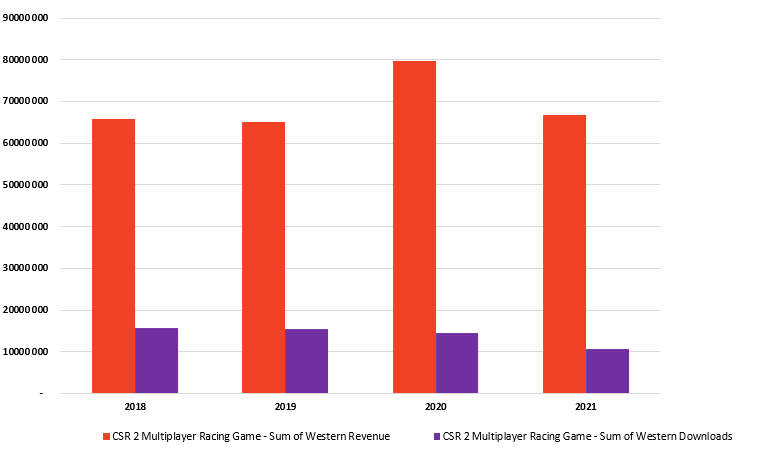

CSR2 by Zynga is in its own league when it comes to racing games on mobile. In 2020, the forever franchise broke all the records. 2021 on the other hand was a return back to normal. Downloads decreased 27% YoY, while direct revenues shrank 16%.

The closest rival to CSR2 in the West is Mario Kart Tour by Nintendo. After the rowdy start, where the game was downloaded 130M times in a span of a couple of months, Nintendo failed to capitalize on the audience as well as it could have and the game’s revenues declined rapidly post-launch. Though to be fair, Mario Kart Live has grossed over 180M in net revenues after October 2019. A very respectable amount.

In 2021 Mario Kart’s downloads decreased by 37% in the Western markets. That was followed by a drop in revenues of around 22%.

A special shoutout goes to Need for Speed by EA (+16% revenue growth) and Top Drives from Hutch (+23% revenue growth). Hutch was acquired by MTG for $275m +$100m in earn-outs a year ag and it really seems that the acquisition is paying off really well for both Hutch and MTG.

Finally, a super special shoutout goes to No Limit Drag Racing 2 from Battle Creek Games, which was released last and climbed to top-5 of the genre beating the likes of Gameloft’s Asphalt 9. The publisher clearly read our last year’s prediction and capitalized on market openings. Good job!

The Clash Games

From Fishing Clash to Hunting Clash, Tennis Clash, Baseball Clash, and F1 Clash 🤯

Fishing Clash by Ten Square Games couldn’t follow the record year o 2021. They had 43% less downloads compared to the year before, with 15% decrease YoY in direct revenues. But that revenue decrease is off-set by Hunting clash, which is their latest scaled up title. In 2021 Hunting Clash managed to do 7.5x of 2020 revenues with “only” 2.5x in downloads.

To sum it up, in 2021 Ten Square Games managed to keep their 2020 revenues while losing around 20% of downloads.That nevertheless didn’t please the shareholders as the stock price got cut in half during last year. Partly due to lack of growth. And partly due to failed M&A negotiations with an undisclosed acquiror.

Tennis Clash also suffered after the record 2020 year. The game lost 26% of their direct revenues and 17% of downloads in 2021. This is probably a good indicator of the game’s problems with long term retention and monetization respectively. But to be completely honest and fair to them, their 2020 was super fantastic so it may be over-ambitious to expect growth after such a year.

It’s worth mentioning that there were no new significant tennis games to challengeTennis Clash. With tennis being such a popular sport, there for sure is room for more than one in the market. Tennis Rivals anyone..?

F1 Clash by Hutch (MTG) was released in 2019. They managed to grow their direct revenues for 36% in 2021 despite having 21% less downloads. Obviously, they are doing Clash meta well and it could be a good example for Wildlife Studios to look upon with their Tennis Clash title.

Baseball Clash by Miniclip was released in March 2021 so it’s yet to hit full 1 year of performance after which we can see Miniclip’s ability to scale itif the game scales or not. Given the collapse of Tap Baseball by Glu (EA), there’s definitely room for another baseball title.

Sports Manager Games

The sports sub-genre with the most impressive growth by far

In terms of growth, the Sports Manager sub-genre did the best in the whole Sports & Racing category by exceeding the annual growth rate of the rest of the market at 35% year-over-year.

Top Eleven, F1 clash, Top Drives, and Football Rivals (Miniclip’s strategic investment) had an amazing year of growth. After Miniclip strategically invested in Football Rivals, they used some of the tricks from Miniclip’s sleeve and grew 4x in downloads and 4.5x in direct revenues.

Last Year’s Predictions

We got 6 out of 8 right!

Prediction #1: Attack of the Clones

Non-franchise-based realistic sports games like 8 Ball Pool and Fishing Clash will keep growing in 2021 and will continue to outperform real-world franchise games, as they are not susceptible to pandemic’s adverse and unforeseeable effect on real-world leagues.

MISS: Non-franchise-based realistic sports continued to outperform real-world franchise games but didn’t grow. No new titles, both direct imitations as well as versions with a tacked-on IP, emerged.

2021 Prediction #2: Franchise Sports Continue Their Losing Streak

Franchise sports, especially NBA, will continue to stagnate in growth and downloads, given the continued adverse effect of the pandemic on real-world leagues/franchises in 2021. We expect massive growth to come in 2022 when the pandemic is very likely behind us the stadiums are once again filled with fans.

Hit: All franchise sports-based games (NBA, MLB, FIFA, Madden) except T2’s NBA stagnated or straight up declined in both revenues and downloads.

2021 Prediction #3: Smart Small Developers Find the Niches

Arcade Sports lends itself for market entry for smaller developers. The games are focused around addictive, usually physics-based, core games with an element of familiarity injected by a tie-in to the real sports.

Miss. Not a single small western developer managed to enter the arcade sports category. Miniclip is leading the category in downloads and the ability to spin-off and scale new games.

2021 Prediction #4:Top Eleven will continue to be the market leader and not face any significant reduction in its market share from other football manager games.

HIT: Top Eleven increased its dominance in the sub-genre.

2021 Prediction #5: Hutch will continue to heavily scale and expand its F1 and Top Drive racing manager games fuelled by its recent acquisition war chest ($275 million) which could be used for more IPs tie up’s real-world racing events and influencer campaigns.

HIT: Both Hutch games grew 25+% YoY.

2021 Prediction #6 Arcade Racing will continue to be very fragmented and characterized by lower production-value, hybrid revenue (ads+IAP) games.

HIT. A significant newcomer with a high appeal IP didn’t happen. Some new, lower production-value, hybrid revenue (ads+IAP) games emerged tough.

2021 Prediction #7: CSR2 will remain the sub-genre leader with more than 40% of the market share in 2021.

HIT: CSR2 is still the sub-genre leader.

2021 Prediction #8: Since we believe this year’s growth was fueled by the lockdown, we expect to see a revenue decline for the Racing genre in 2021.

HIT: The whole Racing category was -9% in revenues YoY.

2022 Predictions

2022 Prediction #1: EA sports mobile will course-correct their sports franchises (NBA, MLB, FIFA) and with the release of at least 1 new sports title will finally manage to grow YoY. This decline can’t continue under Jeff Karp’s watch.

2022 Prediction #2: Zynga’s Golf Rival and Miniclip’s Ultimate Golf will come closer to EA’s Golf Clash and close the revenue gap, but Golf Clash will still stay the #1 golf game.

2022 Prediction #3: There will be at least one new racing title that will come into the top 5 racing games.