Can Supercell Boost Beatstar Into a Major Hit

Written by Javier Barnes and Michail Katkoff.

This post is sponsored by Xsolla. If you’re interested in growing your business on mobile and beyond, look no further. Xsolla has dedicated tools that will help you create your own online commerce platform, improve your performance marketing and discoverability, and expand your game business on mobile and PC. Check out Xsolla’s solutions for more information.

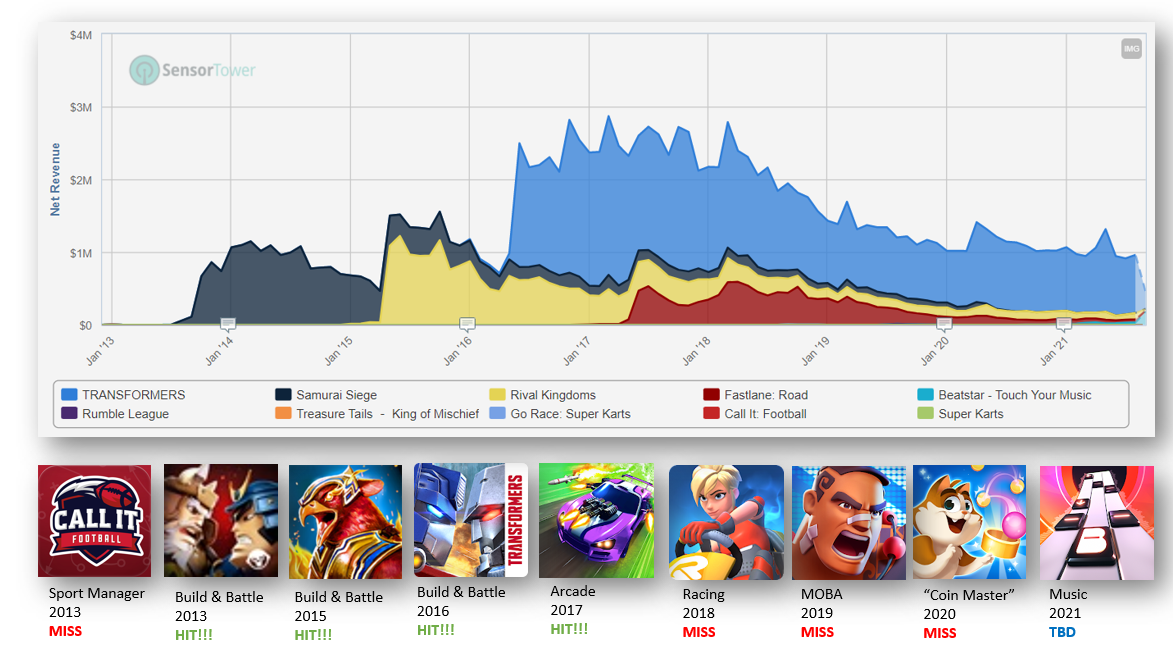

For nearly five years Space Ape has been a proud member of the Supercell investment portfolio. Yet despite a very healthy pipeline of new games and a string of polished games in soft-launch, Space Ape was not able to produce much-coveted hit titles.

The launch of Beatstar is interesting not only because it’s an incredibly well crafted and fun game, but because it is in many ways the first game published by Supercell: It has Supercell ID, it has been heavily cross-promoted inside Supercell’s games and even the Supercell CEO gave it a major shoutout in his yearly blog post.

If Beatstar becomes a major hit, it will not only be great for Space Ape, but it will prove that Supercell can rub its magic to its portfolio companies as well.

Space Ape Games

In September of 2020 Space Ape, a studio majority-owned by Supercell did it again: They soft-launched a highly polished and fun game in a genre they had no previous experience in.

But unlike in previous attempts, Beatstar passed through the soft launch and began its global launch just a few days ago. The global launch of Beatstar signals the end of a long drought. It’s the first game to come out of the studio since they got laced up with the Supercell rockets. We don’t count Fastlane, since it was already in soft-launch when the two companies got hitched.

Space Ape has been working with Supercell since 2017. Beatstar is the first game to reach the global launch stage since the studio joined Supecell’s portfolio.

Space Ape is a very interesting and accomplished London-based mobile studio. They first came into prominence with Samurai Siege, a Clash of Clans follow-up with samurais. The studio then followed up this game with two other similar titles that both found moderate success on the market.

Space Ape also positioned itself as a highly efficient operator of live games: Their whole mantra was unlocking as many developers as possible to work on new games by creating tools to operate live games efficiently.

Their admiration towards Supercell and their expertise in lean live operations was likely what secured their deal with Supercell, who acquired majority ownership of Space Ape in mid-2017. After that, Space Ape has been clearly boldened to take riskier shots as they’ve seemingly pursued big hits without focusing on building a specific genre nor audience expertise.

We always advocate for genre and audience mastery, urging studios to focus on building expertise rather than constantly trying something new. Expertise and focus are the best way to methodically work yourself up to a hit game.

Why genre focus matters:

builds faster the internal know-how of what works and doesn’t work in the genre.

accumulate learning how to market to a specific audience.

allows sharing of features and codebase, leading to faster development cycles.

grants internal benchmarks for testing.

But there are exceptions to this rule. Supercell was one of them, though as of late even they have had challenges growing outside PvP mid-core games.

Space Ape found its stride by focusing on Build & Battle games, which still bring 80% of the revenue. Based on soft-launches Space Ape hasn’t had a focus entering vastly different genres. The studio has a proven ability to develop almost any kind of game. Till date, the developer has been less successful in scaling games outside Build & Battle though.

While Playrix and Scopely are a multitude larger publishers, they are much more conservative when it comes to entering new genres. In case of Scopely the new genres are entered only when the publisher finds a developer with experience in the genre and builds an internal team with genre expertise.

To be clear, it makes all the sense for publishers to enter new genres and new audiences: Operating in multiple genres increases publishers’ ability to grow their overall market share and shields them from market volatility where certain genres overheat.

We urge publishers to study how the best in the business achieve portfolio diversification. They don’t abandon their previous expertise but rather build on top of it. Or they jump on an opportunity with an acquisition of a studio and talent, allowing them to leapfrog the painful knowledge accumulation phase.

Space Ape is moving counter to the conventional approach. The developer has been diversifying its portfolio with genres and games that seem far off their internal accumulated core competence. A strategy that is clearly the one from Supercell. And while Space Ape (and Supercell) has succeeded in soft-launching highly polished and vastly different games, they are yet to find sustained success outside their core audience.

But the story might be different with Beatstar…

The Launch

Beatstar was soft-launched in September of 2020 and it got its global launch just a year afterward. The game showed its hit potential early as it was touted by the Supercell CEO in his yearly blog post.

What’s most interesting about the launch of Beatstar is how much Supercell was involved in native cross-promotion. The game has Supercell ID as the first non-Supercell game ever. It had integration of songs from key Supercell games. And Supercell promoted the game through all of its media channels.

Supercell made native cross-promotion inside their games for Beatstar. And they went as far as producing songs into Beatstar for all four of their live games. This speaks volumes of how invested Supercell is in the success of Beatstar (and Space Ape).

The surprising part is how few downloads the game got despite the highly accessible nature of the game and the massive help from Supercell as well as the platforms (Play and App Store). and you’d In just a couple of weeks that game has been installed 4M times and is likely to get 9M installs during the first month. This is nothing to sneeze at. But it’s also likely less than what Space Ape expected. With the extensive cross-promotion from all Supercell’s games, you’d expect more. On the other hand, Beatstar looks to be on its way to surpassing the other prominent music franchise and will likely have double the installs of SongPop 1 over its lifetime.

As of the moment of writing Beatstar, it’s the 33rd most downloaded game in the US on iPhone. It will be interesting to see how long they can hold to the top 50 position.

Music games haven’t traditionally been very well monetizing on mobile.

The challenge of scaling Beatstar is in the poor monetization of the music games. With organic traffic being what it is, Beatstar, just like all of the game on the market, has to rely on performance marketing to continue its growth. In other words, increasing LTV and decreasing CPI is crucial for Beatstar to continue to scale.

Looking at the revenue-per-install 2 weeks post global launch is misleading, since the game is flooded with visitors who will churn out and cause the revenue-per-install to steadily increase post launch. But looking at the previous top music games, as well as Beatstar’s performance in Canada during soft-launch there seems to be a relatively low monetization ceiling that Beatstar will have to quickly break in order of becoming a top grossing hit.

Globally, Beatstars performs the best on iPhone. This is both blessing and a curse. The good part is that iPhone players monetize better and Space Ape has leveraged Apple Music, which likely gotten the co-operation from Apple. The bad part is that marketing on iOS is much more challenging post IDFA. How are they going to keep growing post Apple featuring?

Like all Supercell games, Space Ape also starts their soft launch in Canada, so we can see how the game performs in this tier 1 market and predict what the future holds. The growth of RPI has been consistent ever since launch, which is good. Yet the game’s RPD (revenue per download) seems to be flattening at around 50 cents. This makes it hard to invest in marketing.

Game Overview

Beatstar’s gameplay will feel familiar to anyone that has played rythm games before. While a song is playing, the player must tap, swipe or hold the finger on top of a series of inputs at the appropiate time, matching the beat or sound effects happening in the song.

The mastery layer of the game is entirely based on dexterity. Improving reflexes and muscle memory, mastering the song patterns and timings, and learning appropiate finger techniques to get a bit more score.

Although this might seem like a simplistic approach, the history of legendary game series like Dance Dance Revolution (DDR) or Guitar Hero (GH) speak volumes of rythm games’ large audiences.

DDR’s gameplay is based on performing the right input at the right time, and Guitar Hero uses a lane structure.

Beatstars’ mixes both concepts, and expands the amount of inputs to those native on a touchscreen.

The gameplay execution of Space Ape here is superb. The tactile feel is fantastic, and the inputs patterns match perfectly with how the song feels, which ultimately becomes very immersive. So if you have a soft spot for music, like most people do, Beatstar hooks you immediately.

Beatstar’s look & feel of Beatstar is amazing: Great responsiveness, non-intrusive visuals and inputs that feel perfectly in-sync with the songs.

But don’t think that this is simply “a well-crafted version of DDR in mobile”, or just another in the list of the games for mobile (Deemo, Cytus, Archaea, VOEZ…). There are several factors that make Beatstar stand out and establish a very unique identity:

#1 Focus on the Western broad audience

Most rhythm games are primarily focused on the Asian market (DDR, Ouendan, Hatsune Miku: Project DIVA…), or on a particular subset of music fans (Guitar Hero, Rocksmith…).

This means that those games often feature art direction and soundtracks that aren’t immediately recognizable or appealing to a random person in the US or Europe.

On the contrary, Beatstar’s song set is primarily composed of contemporary pop music, as well as mainstream themes that will be easily recognizable by the western audience (Nirvana, blink-182, Gorillaz…). This repertoire of pop hits is actually one of its most powerful unique selling points.

In terms of visuals, Beatstar has chosen a neutral, aseptic, and serious approach. There are no characters or narratives here. In terms of UI, it reminds more of a music service app than of a game. A strategy targeted to appeal to a broad casual audience which may not have to be gamers, but music fans. Just like Design Home is a home decoration game for those who don’t play games, Beatstar is a music game for those who don’t play games.

#2 Arcade format

In the line of targetting a broad casual audience rather than gamers, Beatstar aims to deliver a faster, small-sized, and more pick-and-play experience than other rhythm games.

For example, instead of entire songs, Beatstar only features short remixes of about 2 minutes. This allows the gameplay to skip songs to the parts that are more catchy and relevant for the gameplay, ultimately making it more intense.

Another point that makes the experience more intense is that a single mistake will make you fail the song. This is contrary to the mainstream rule on rhythm games, which generally allow you a certain amount of fails or let you end the song and then show you a bad score.

While this introduces a continuous mechanic that could be useful in monetization, it also seems a double-edged sword: It means that Beatstar can’t be played in a relaxed way. It requires absolute focus, and therefore it may limit the capacity of casual players to play on the bus.

Don’t get it twisted. Beatstar is not a relaxing game. It requires full focus. Because when you miss and you pay for it!

#3 Focus on collection

Another unique element in Beatstar is that player progression is structured around building up the song collection. This is atypical on rhythm games, where in most cases the songs are simply grouped by difficulty or style, but the player doesn’t build up an inventory of them.

On Beatstar, players collect cards from a certain style until unlocking a random song from that style. There are even situations where the players must choose which style they want to develop.

Upon opening the chests, players can often choose the genre they want to have next. But the thing is, the more songs they get in their favorite genre, the more cards they need to get the favorite song. This pushes players to choose genres they normally wouldn’t listen to.

Given that musical taste is something extremely polarizing and in many cases big parts of what defines us (a rocker, a metalhead…), the premise of building a unique collection it’s very powerful.

But it’s kind of a promise unfulfilled at the moment. The progression is so gated at the moment that it forces players to master every single song they have, even if they absolutely despise them. And given the exclusive focus on mainstream hits, the decisions are more a bit of an anecdote rather than something that allows you to express your personality through your song inventory.

#4 Immersive level design

Finally, a peculiarity that generates a big effect is how well crafted are the patterns. Songs are divided into 5 shorter stages of increasing difficulty and feature regular patterns that generally repeat on each of them, but requiring more challenging inputs every time.

But perhaps the most relevant factor here is that, contrary to being only beat-based like in DDR or Audiosurf, or to focus on a specific instrument partiture in Rock Band or Guitar Hero, in Beatstar the inputs are primarily based on vocals and lyrics.

This means that the game will require you to hold a note to match the singer making a sustained sound, tap buttons for each syllable pronounced, or perhaps swipe up to match vocoder effects that make the voice pitch higher.

On paper, it may sound very subtle, but it’s one of the factors that make Beatstar so immersive: Vocals are the king of all instruments and the most recognizable and easier-to-follow element on a song. By linking their patterns to it, Beatstar becomes much more intuitive than other rhythm games.

The Player Progression

The main progression axis in Beatstar is stars. Stars unlock features, rewards and increase the list of possible songs in the boxes, in a way similar to Supercell’s trademark Trophy Road.

Each song can grant up to five stars, based on the score achieved on it. In normal difficulty, an experienced player gets three to four stars often with a first try. And with some practice, they finally can get their fifth start after which there is no point in playing the song again.

Then there are Hard Songs, where getting more than two stars is already quite difficult. The idea behind them is to create a fun challenge. But at the moment they don’t give players any more rewards. In fact, they reward players less since you’re more likely to fail the song and thus get fewer points towards opening your next box.

The player's overall score in the leaderboards is the sum of the individual score of each owned song. The more songs, the more scores to sum, and the bigger the number of stars and total score. So regardless of the player’s ultimate goal is to increase their collection or to raise on the leaderboards, the process is the same: They need to get as many songs as possible.

Songs are obtained by accumulating cards of a specific music style. The cards are obtained in boxes that are granted when playing, in a way similar to Clash Royale.

Once enough cards have been collected, the player obtains a random song of that particular style.

Beatstar core loop is straightforward and easy to comprehand for a broad audience. The hard lock on waiting feels much more punishing in this game than say in a puzzle game when you run out of lives-

To summarize, the game mixes the chest mechanic of Clash Royale with the combined Trophy system of Brawl Stars. This model has worked in other Supercell games because it isolates a lot of the gameplay from the progressions systems, and incentivizes mastering the content already owned.

But there is a problem. Contrary to those games, in Beatstar grinding is not very fun.

Surely some hardcore players will have no problem replaying the same song endlessly to reach that fifth star, but this is not the normal behavior.

For most people, the most fun part of the game is playing new songs, which quickly becomes a rare event. Players’ progress stalls quickly to a point where they are playing short sessions where they try to master a song before getting kicked out of the game due to fill-out box slots. You end up in a position where you’ve maxed out your limited collection and you’re just waiting for the next song to unlock so that you can max that one too.

Additionally, the game also presents an Events section, which unlocks a bit late on the progression (135 stars). We will save you the trouble of having to pay for songs and master them all to check out which awesome events are running to celebrate the global launch: Right now there’s nothing.

Beatstar had events at launch that unlocked when players had acquired 135 Stars. A goal that heavily pushes to monetize.

After paying tens of dollars and unlocking the Events, these highly valuable players are disappointed with a note that Events are actually not yet in the game.

CORRECTION: events are in the game but were not active at the time of playing. There was no communication when they would be activated. Thus the negative emotions are still there for the paying audience who rushed to unlock them.

Monetization

Songs are the most valuable resource, and monetization is linked to their acquisition. Nothing too surprising here: Players can purchase loot boxes that grant a random song of a specific genre, as well as directly by a featured song that rotates every day.

If you don’t pay, then the amount of new songs you get is slowly dripped to you. This model makes sure that a small fraction of the players spend a lot of money to get as many songs as possible and raise their scores on the leaderboard.

Ultimately, it seems that Beatstar monetization is in direct opposition with the main premise of the game: discovering new songs and interacting with them. Monetizing by selling songs demands heavily decreasing player accessibility to them, therefore removing the reasons to play.

As a consequence, in this game the monetization is not a booster of fun, it’s a blocker.

And the lingering question is if it wouldn’t be more worth than going for a monetization model that allows lower ARPPU, but higher conversion. For example, through a subscription or a Monthly Pass system.

Players can acquire more random songs of a specific style by buying loot boxes.

In that regard, perhaps the most controversial element in monetization is the hidden energy system: Once you fill all your box slots, Beatstar won’t allow you to keep playing. Either you pay for a skip and free one of the slots, or you leave for some hours.

How Beatstar limits session length feels extremely punishing. Especially considering that is a skill-based game where players will want to practice and retry many times to get the five stars. At the moment, you only have a few tries to get a high score before filling up the boxes and having to stop playing. It would likely be better for monetization and engagement to let the player practice on a song even when all box slots are full - and if they happen to hit a new high score, you could sell them the ability to register the score by paying some hard currency.

In other words, Beatstar is an anti-consumer version of the Clash Royale chest system, and it perfectly illustrates our point on monetization being an enemy: In Clash Royale, you would pay a skip to get more value for your play. You pay to increase the fun. In Beatstar, you pay so that the game doesn’t take away the fun at all.

Unlike in Clash Royale, Beatstar kicks you out of the game when your box slots are full. You can’t play just for fun. “Get out or pay” is not a modern way to monetize.

Interestingly, the game also features valuable ad-based monetization points, like the ability to skip short-timers or get extra cards by watching ads or getting a few gems per day. But these opportunities are heavily limited, so players can watch ~3 per day maximum. Therefore, we doubt the significance of ad revenue in Beatstar.

Space Ape has ad monetization. An ability to skip 3 hours by watching an ad is extremely generous. Player can also watch an ad to get few more cards. The opportunities above come few and far between. An engaged non-monetized player is likely to watch 3 ads in a session. There’s definitely room to crank this up.

The Next Steps

In our opinion, there are three main points where Beatstar should focus to improve its overall chances to become a hit:

Branding

Ultimately, what will determine the success of Beatstar is its capacity to become viral, or at least get enough visibility to reach a massive amount of casual audience. To achieve this, a big weapon on Space Ape’s arsenal is to partner with famous artists, labels, and music apps.

Right now the game gives a free song if opening a premium account with Apple Music. This may be a good way to get a launch featuring. But to reach the masses, it should have a partnership agreement with Spotify or Tiktok, promos by top artists, and even exclusive songs.

Given enough volume of users, it could even be a good platform to promote new albums.

In our opinion, a deal could be juicy for music subscription apps as well: Beatstar is a great way to discover, promote and engage with new music, as well as to make users interact with each other. In fact, if we were at Spotify we would be thinking right now on how to integrate a rhythm game like this into our platform.

Monetization

We think that a subscription model, or a model that aims to build a long LTV through high conversion and retention (i.e. Monthly Pass), is more suited for a game that targets a broad casual audience like this one.

It's hard for us to imagine that the greatest monetization potential in Beatstar is creating whales through gacha mechanics and frustration over having to grind.

It seems more likely that a broader audience would pay 10$/month for a long time. A softer subscription-like model would allow to:

Focus the game on its more fun concepts: Discovering new music.

Allow players to focus on the styles they like and avoid the ones they don’t.

Allow players not interested in competition to choose a lower difficulty level, enjoying the game as a relaxing soft activity, while still allowing hardcore players to go nuts.

Remove the systems that require pay-to-play (song acquisition gatings, energy systems), which in our opinion do harm adoption.

There’s also an upside on the ad-monetization side. But to truly capitalize on ad monetization the game would need to have much more head-to-head competition as in Words-with-Friends. The current design of the game is simply not suited for that and was clearly made without an emphasis on ad-monetization.

Social and Competition

Finally, the game's social aspects could be considered in the bare bones at the moment. Other than the leaderboards and an automatic challenge system that grants no rewards, there are no meaningful interactions with friends.

The most noticeable social feature right now is an automatic challenge system without rewards that triggers automatically when a friend surpasses your score. A fun treat, but not game changing.

The game could empower this aspect much more, for example by allowing players to trade songs with each other, or allowing friends to visit and play the collection of others, granting them a share of the rewards. As well as by allowing them to create a band and compete against others in events.

The game could also double down in terms of competition, for example creating a leaderboard per song, as well as events that allow players to compete on a set of songs even if they don’t own them, or add synchronous PVP.

This would be a good way to allow skill-based competition unrelated to player inventory and break the monotony of having to replay constantly the same pool of songs.

Takeaways

Beatstar proves once again that Space Ape can build almost any kind of game. Not just that, but actually deliver something that is highly polished and fun to play! Yet despite the engaging gameplay, the close cooperation with Supercell, and the impressive download numbers, Beatstar doesn’t seem to be a hit (quite yet).

The low RPDs (revenue per download) in tier one markets hints that the game may have challenges in keeping up the marketing once the organic traffic starts decreasing, which will be key to scale up their revenue. After close to a year in Canada, Beatstar has grown its RPD to around 50 cents, which is quite low to support the game with extensive marketing.

The lack of social and competitive features bundled with a somewhat crude monetization system (pay or stop playing) can be all fixed. And we believe that improvements in those areas will unlock further growth.

The question is why did Space Ape choose to launch this game when it hadn’t, at least based on Sensor Tower data, reached sufficient monetization numbers? With key features (events) and improvements coming in late, Beatstar is at risk of burning out its golden cohort. Continuing live service against declining numbers is a massive challenge to any team.

Supercell’s deep pockets and amazing top-of-the-funnel marketing capabilities can perhaps unlock more growth to Beatstar. We can see this game being played by influencers (musical artists), which in turn could turn the game viral again. Then again, getting Dua Lipa and Da Baby to play Beatstar may require a bit too steep of an investment with too murky of an upside for an analytical company like Supercell and Space Ape to jump on.

Personally, Beatstar has been one of the highlight mobile games for us. It’s a truly fun game to play. A game like this should thrive in the mobile games market. So we are definitely rooting for Space Ape to capitalize on it. Our professional opinion is that the game was launched too soon and it will now have to rush to get the new features in to turn the (predictable) post-launch decline into an ascend. But Space Ape has Supercell backing them up. So the uphill should feel a bit less steep.

With Xsolla you can easily launch your own cross-platform player account system Let your players stay connected and engaged no matter which platform they play on. The money you save on platform fees will go directly into further improving and growing your games.