2021 Predictions #5 Sports Games Race into a Billion Dollar Club

This analysis is written by Mladen Dulanovic, Game Lead from Nordeus, and Om Tandon, UX Director at UX Reviewer.

Access all of our previous predictions. Signup for the newsletter. Apply for our Slack group.

Our 2021 predictions have been sponsored by Facebook Gaming.

Facebook Gaming helps developers and publishers to build, grow, and monetize their games. This is done through in-depth research, insights, and case studies as well as innovative marketing solutions and education materials.

Visit Facebook Gaming where you’ll find an incredible amount of insightful, actionable, and relevant information along with tips, tools, and solutions to help you grow your business.

Unless otherwise specified, all the data has been provided by the powerful Sensor Tower and analyzed by the author(s). All revenue numbers show net revenues. Data from China, Korea, and Japan are excluded as this analysis focuses on Western markets only.

Finally, please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exact figures.

Despite being the smallest category by revenue share on mobile, 2020 was a very good year for Sports & Racing as it breached the billion-dollar mark, with combined revenue of $1.2B compared to $827M in 2019. The category saw double-digit growth of +30% YoY, compared to just +17% in 2019. Sports saw YoY growth of +29% ($880M), while Racing registered +23% YoY ($331M). All sub-genres enjoyed a healthy double-digit revenue growth that helped the category to finally push past the billion Dollar in in-app purchases mark!

Sports games are by far the smallest in total share of the revenues though when it comes to downloads, these games hold their own.

On the downloads side, all sub-genres saw substantial to marginal YoY growth throughout the year, especially around Q2 of 2020. when the first wave of lockdowns hit. The only exception being Sports Manager, which saw a decline of -51% YoY.

In terms of major category trends, not much has changed from what we covered in our 2020 predictions, but there are some interesting deviations:

Lion’s share of revenue in both Sports & Racing genres was still brought in by a handful of higher-production-value titles with IP-tie-ins like CSR Racing, Mario Kart Live, and FIFA. Games that have a huge fan base. Given the number of studios contending for IP's have gone up in the past few years, you need deeper pockets and longer development times to produce a quality product that can hope to become a contender against established players. This increases the barrier to entry limiting the sub-genre to only a few publishers. In that sense, it’s much like on PC and Consoles, where EA grabs the sports’ crown jewels.

EA Sports took a loss due to real sports franchises suffering from the effects of the pandemic. In other words, as the franchises like NBA postponed their season and lost viewership, so did the NBA mobile game. Original IPs like 8 Ball Pool and Fishing Clash on the other hand kept on keeping on as they weren’t affected by the real-world problems.

As real sports franchises suffered loss of viewership, so did the licensed sports games evolving around those franchises.

Overall, the Sports category didn’t see any new notable chartbusting entrants. The growth we are seeing is fuelled by existing games increasing their market share and becoming better at live-ops. The key growth drivers were thus on the meta side through genre-blending features like quest systems, battle pass, enhanced social and various collections as well as power progression mechanics.

Last Year in the Sports Genre

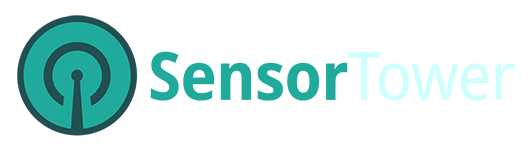

The Sports category registered a healthy double-digit revenue growth of +32% YoY, downloads were up by +12% YoY compared to 2019. Mirroring the Racing and many other genre trends, maximum growth in both revenue and downloads came between Q1/ Q2 in 2020, owing largely to the lockdowns. As the installs normalized after the first wave of lockdowns the revenues declined but continued at a significantly higher level, which speaks of improved live survival capabilities of key sports games developers. Towards the end of the year, the installs bounced back up again as the second wave of lockdowns began.

The tiny Sports Management sub-genre saw impressive growth of +39% YoY, but the real surprise this year came from the general Sports sub-genre which grew 31% compared to 4% in 2019. This uplift can be attributed to impressive YoY growth rates achieved by the key titles that we will analyze in this post.

Since 2018, revenue seems to be showing a declining trend in the Sports genre. Without the lockdowns, the trend could have been worse. On the other hand, several top-grossing licensed sports games suffered also from the lockdowns.

The sports category is divided into two genres: Sports and Racing. The chart above shows how the Sports genre faired.

The Clash of Golf Rivals

Golf Clash saw its revenue market share of the sports sub-genre almost halve down in 2020. This is mainly attributed to Golf Clash’s direct rival, which is unsurprisingly called Golf Rival by the Asian publisher behind GR Sports Club. A publisher is known to get shamelessly inspired by other sports titles with titles like Pool-8 Ball Game. We also witnessed Tennis Clash picking up the pace and registering massive growth, though with the game being so different, it is arguable that the game's growth didn’t eat much into Golf Clash’s decline. On the other hand, every golf course tends to have few tennis courts, so there might be some audience overlap there.

Playdemic, the developer behind Golf Clash, is not unaware of the competition. It seems that the company has been thoroughly experimenting with better ways to monetize its existing user base via the introduction of features like Battle Pass, deeper live ops, tournaments. But these experimentations are yet to pay off in a bigger way. While Golf Clash saw it’s downloads decline YoY by -46%, Golf Rival saw it’s downloads grow by +38% in the same period. This speaks of the aggressiveness from the rival’s front to capture market space from the market leader. On the revenue side too Golf Clash saw a YoY decline of -10%, while Golf Rivals made a massive stride of +127% YoY revenue growth. Given how closely Golf Rival mimics Golf Clash’s production value and core game mechanics, it is clear that the battle has moved from the product to user acquisition front.

While Golf Clash saw it’s downloads decline YoY by -46%, Golf Rival saw it’s downloads grow by +38% in the same period, which had an effect as Golf Rivals made a massive stride of +127% YoY revenue growth. It sure looks like the Asian publisher behind Golf Rivals, GR Sport Club, has reached product parity and taken the battle on the marketing side where it seems to be getting an edge over Warner Bros’ Playdemic.

Tennis Clash Goes Gucci

Launched in the last quarter of 2019, Tennis Clash from Brazil based Wildlife studios, rose to the top of download charts worldwide, ranking in top 10 most downloaded games in over 100 countries.

2020, was a very good year for Tennis Clash as it managed to grow it’s revenue by +331% YoY and downloads to +104% YoY.

Tennis Clash’s rich production & art quality, simple and fast-paced core gameplay mechanics, combined with world-class art, UX/UI, and pleasing on the eye graphics make it a pure joy to indulge in. Not to mention that there are not significant tennis games to compete against all while tennis is one of the biggest sports in the world followed by both men and women.

Wildlife raised a funding round of $120 million in August 2020 with a whopping evaluation of $3 Billion. We believe this war chest will help Wildlife further expand and scale its top-performing titles like Tennis Clash with more real-world partnerships, endorsements, and influencer campaigns in 2021.

Tennis is emerging as the second most popular arcade sports game after Golf. There is a high probability of Tennis Clash facing rivals from other developers in 2021 which will put pressure on the product and especially the marketing side. But given how powerful Wildlife’s user acquisition capabilities are, only rivals with an IP and equally engaging core gameplay can truly challenge Tennis Clash.

Fishing for the Top

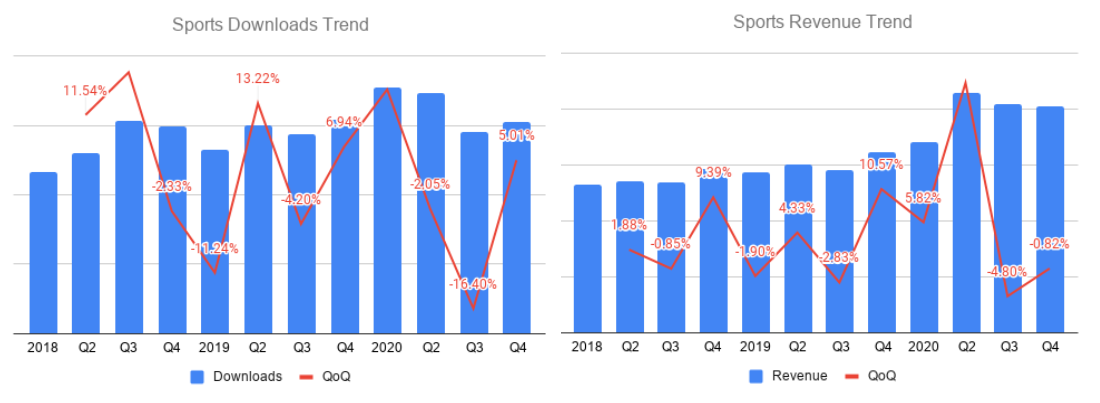

When we think of Sports games, we think of FIFA and Madden. But in fact, both 8-Ball Pool and Fishing Clash performed better that the top EA franchises last year.

Mini Clips, 8 Ball Pool is still numero uno with the biggest share of the sports revenue pie. The game registered a healthy growth of +30% YoY in revenue and a modest +17% YoY growth in downloads. 8 Ball continues to be the sub-genre leader in 2020 but with a very narrow lead of just 1% over Fishing Clash.

Fishing Clash shot past FIFA, displacing it from the second position in 2019. With a 19.3% market share, Fishing Clash has had an impressive run this year, reeling in +155% YoY revenue growth and +162% YoY growth in downloads. It seems to be closing fast on the current market leader 8 Ball Pool.

Fishing Clash’ KPIs are off the hook. FC’s downloads are just a fraction of the downloads 8 Ball pool generated in 2020, but looking at the marginal difference in revenue. Fishing Clash is, either way, better at monetizing its user base compared to 8 Ball Pool or it’s way more efficient with its UA funnels for acquiring high LTV players. Most likely, both.

FC’s precision & timing based player input mechanics allows players to reel in a wide variety of fish and go head to head in PvP duels. The game also has collection and gacha design elements along with some educational nuggets for fishing aficionados. The realistic look and feel of various art assets and environment feels quite convincing and immersive for quick fishing fun. However the game’s biggest drawback is it’s UX and UI, which can feel a bit clunky, crowded information hierarchy, screen info. & layouts, UI style and interaction patterns look dated compared to many other current uber polished arcade and sports genre games.

Just a personal opinion but it feels like Fishing Clash would benefit immensely from revamping it’s UX/UI design in line with the prevailing trends to become more accessible for players. This could allow them to expand the audience and find even more success.

EA Sports Takes an L

The biggest loser this year seems to be EA Sports. FIFA Soccer, which was neck to neck with 8 Ball Pool in 2019 seems to have lost ground and currently trails after Fishing Clash. However, there is good news for FIFA fans as EA is gunning to launch 6 new mobile-based FIFA games as per their CEO Andrew Wilson. And while we’re fans of FIFA on both mobile and console, 6 new games sound a bit like overkill, especially if they are launched in a relatively short period of time such as 12 to 18 months.

But as of now, EA sports woes do not end here, Madden NFL football and NBA live mobile basketball also seem to have taken some serious beating in 2020. Madden saw its fortunes erode to the tune of -41% YoY, while NBA Basketball saw the fall to the tune of -26% YoY, compared to the same period last year. But you can’t really fault EA for the decline. These leagues have faced huge losses in the real world due to the effect of the lockdowns and to some extent the social unrest in the US. Cancellation of matches, unusual game times, and shorter playoffs all led to lower viewership, which directly translated to the popularity of the games.

Glu mobile on the other hand seems to have an evergreen homerun with MLB Tap Sports series on its hand. The yearly new MLB title continues to knock it out the park while the previous version is sunset. The model of launching a new game instead of updating the existing one, as EA does it, sounds like a horrible idea. I mean, you essentially have to re-acquire all the players to the new game. Nevertheless, Glu has perfected this and it seems to work like a charm year-after-year.

You Don’t Always Have to Go Big

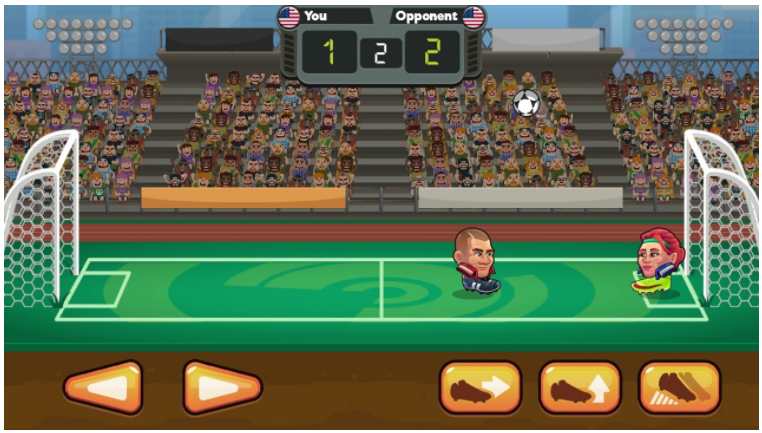

Masomo, developer of Headball, was acquired by Miniclip back in Feb, 2019 and has the backing of a world class publisher to scale the game even further in 2021. We look forward to it’s continued growth in 2021.

Last but not least of the noticeable games in 2020 was Headball 2 from Masomo which experienced revenue growth of +36% YoY. It’s a cute and highly addictive game that is simple but hard to master. Handball 2 embodies all the simple elements of arcade gaming; simplistic art style, arcade SFX, character movements which made them fun to play on arcade machines, right down to the look and feel of the controls. It really shows that you can achieve a moderate level of success without spending too much on production value and by finding a niche that is underserved by the big players.

Our Last Year Predictions Scorecard for Sports

2020 Prediction #1: Golf Clash will see possibly further erosion of its market share as more direct and indirect rivals enter the market.

Win. Bullseye! We did see further erosion of Golf Clash’s market share, but it still retained the top position in 2020. Games like Golf Battle, Ultimate Golf appeared on the scene competing for the same pie.

2020 Prediction #2: Golf Rival, Fishing Clash, and Tennis Clash will continue to grow their market share in 2020.

Win. Bullseye!

2020 Prediction #3: licensed sports will see further stagnation in terms of downloads and revenue unless new games or untapped franchises enter this sub-genre.

Draw. We did see a substantial decline in revenues and YoY growth for existing real sports franchise mobile games (Madden NFL, NBA Live Basketball, FIFA Soccer). A real shot in the arm for 2020 growth came from non-franchise games like 8 Ball Pool achieving modest growth of +30% YoY and Fishing Clash achieving impressive revenue growth of +155% YoY.

2020 Prediction #4: Sports management games won’t see meaningful growth. Games with a mix of tactical and strategy gameplay elements (FIFA Soccer, Madden NFL) seem to be doing much better than a pure strategy based games (NFL Manager, Top Eleven), this will continue to be true in 2020

Loss. This one was a miss, with Sports manager (Top Eleven) aka pure strategy games performing much better than their mixed counterparts (FIFA Soccer, Madden NFL) this year, but as covered above a lot of this underperformance was tied to unforeseeable effects of the pandemic on the fortunes of the real-world franchise having a trickle-down effect on the mobile counterparts.

2020 Prediction #5: While the wheels are slowing down, given the size and fan base of this sub-genre, we believe there is an opportunity for untapped sports licenses to come in and carve out a lucrative share of the market pie.

Loss. We didn’t see it happen in 2020, but it’s still likely to happen in 2021. Cricket, NHL, UFC are all big sports with non-existent market shares on mobile.

2021 - Sports Predictions

2021 Prediction #1: Attack of the Clones

Non-franchise based realistic sports games like 8 Ball Pool and Fishing Clash will keep growing in 2021 and will continue to outperform real-world franchise games, as they are not susceptible to pandemic’s adverse and unforeseeable effect on real-world leagues.

That together with Golf Rival’s seeming success will encourage more and more developers to move against the existing top titles, like Tennis Clash. We’ll see both direct imitations as well as versions with a tacked-on IP, such as Disney, compete for the players. Most of the challenges will fail not because they can’t make a good game but because they won’t have the tools to compete on the marketing side.

2021 Prediction #2: Franchise Sports Continue Their Losing Streak

Franchise sports, especially NBA, will continue to stagnate in growth and downloads, given the continued adverse effect of the pandemic on real-world leagues/franchises in 2021. We expect massive growth to come in 2022 when the pandemic is very likely behind us the stadiums are once again filled with fans

2021 Prediction #3: Smart Small Developers Find the Niches

Arcade Sports lends itself for market entry for smaller developers. The games are focused around addictive, usually physics-based, core games with an element of familiarity injected by a tie-in to the real sports. These games monetize via both Ads and IAPs and they are not targeted by larger developers because the early net revenues are 15M at the higher range. All of these elements make arcade sports the prime battleground for small developers.

Sports Manager Games

A sports manager is the newest sub-genre added this year, even though it’s the smallest by revenue share ($87M), it registered maximum YoY revenue growth of +44% in the entire sports category though downloads fell by -51% YoY at the same time.

Sports Manager games had a significant decline in downloads accompanies with healthy incline in revenue. That’s a good sign!

Top Eleven Football Manager. despite being 10 years old it’s arguably one of the most popular football manager games ever released. The game saw a major uplift in its revenue and a slight bump in downloads around Q1 2020. Lockdowns seem to have given more time at home to players of this genre leading to higher engagement levels. Nordeus also implemented, now trending “Battle/Season Pass” feature which seems to have had a very good uptick on retention and monetization KPI’s of the game.

Looking at the comparative revenue chart of the top 5 sports manager games above, we can see that Top Eleven (Nordeus), Top Drives & F1 Manager (Hutch) are the 3 games that saw the most substantial revenue growth during 2020. No.2 & 3 spot in terms of market share belongs to Top Drives (19 %) and F1 manager (15.3%), both of which are from Hutch games.

Top Drives is similar to an F1 manager game but without the F1 IP. It relies on stats. based car cards for decision making. The 3D models for cars and race tracks are super low poly, making the game more managerial than racing in nature. From our sources, it seems Top Drives has pretty low early retention but fantastic long term retention and monetization. Since poor early retention makes it very hard to scale the game, that’s why they are working with an IP, Question is: is it working with an IP given the cost for that IP?

F1 Manager from Hutch has struggled to find its lane while Top Drives, which is the other title from Hutch, seems to have picked up the pace. While the F1 license gives an enormous fan base, the question is how deep is the theme compared to Top Drives, where player collects cars from Bugatti to Ram Truck and from Mini to a Maserati.

Regardless, Top Drives saw +66% YoY revenue growth and F1 manager +234% (YoY) which is pretty impressive! With these 2 titles Hutch now commands close to 35% of the Sports Manager market share pie, that’s probably one of the reasons why it got acquired by MTG for $275m (+$100m in earn-outs) in Dec 2020. It’s fair to say that they will look for more growth in 2021 with that access to more money.

2021 - Sports Manager Predictions

2021 Prediction #1: We expect to see revenue decline in 2021, as a lot of the growth for the top titles by market share was fuelled by the pandemic lockdown. We don’t expect the top order to change much in 2021 or any big shake-up due to the entry of a new contender as existing players are well established.

2021 Prediction #2: Top Eleven will continue to be the market leader and not face any significant reduction in its market share from other football manager games.

2021 Prediction #3: Hutch will continue to heavily scale and expand its F1 and Top Drive racing manager games fuelled by its recent acquisition war chest ($275 million) which could be used for more IP’s tie up’s real-world racing events and influencer campaigns.

2021 Prediction #4: Given the traction, car racing manager games are receiving, we might see more such titles appear in 2021. Though given the prior lack of success of these games we don’t see the market picture changing much. It seems that only Hutch has been able to crack the code for the racing manager games.

2020 In Racing

The racing category is characterized by a disparity between the revenue share and the install share. A negative one. For example, Casino games accounted for 2% of total installs, but a whopping 18% of all IAP revenues. In the case of Racing, we’re looking at 4.6% of installs and 1% only one percent of all revenue.

This disparity of revenue to install reflects a huge opportunity. We know that racing has a large audience. We can see it through the impressive installs and the booming sales numbers for key racing franchises on the console. But for some reason, only a few mobile racing titles, such as CSR Racing, have been able to retain and monetize their audience. Most titles simply don’t seem to be able to deliver to this devoted petrolhead audience.

In 2020, Racing revenue has increased by 24% while downloads in the category grew by 25% compared to 2019. If we dig deeper into QoQ, it’s evident that most of the growth for 2020, both in downloads and revenue, came from the first wave of lockdowns in Q2 of 2020. After Q2 the downloads and revenues in the category declined a bit but continued on a significantly higher level compared to 2019.

When looking at the sub-genres (arcade & realistic racing) it seems that for the biggest COVID-19 profiteers we should look at realistic racing. Realistic Racing gained the most during the lockdowns while Arcade Racing continued to decline both in terms of installs and revenue.

In 2020, arcade racing saw 11% increase in downloads and 18% in revenue compared to 2019. One would assume that Arcade Racing brings the majority of the downloads, but that’s not the case. In a way, the hangover from a massive launch of Mario Kart in Q4 2019 continued in the Arcade Racing sub-genre throughout the booming 2020.

Realistic racing saw 35% increase in downloads followed by 27% increase in revenues driven mainly by the success of CSR2.

Arcade Racing offers an unrealized potential for both large IP holders and small developers

In his deconstruction of EA’s Need For Speed, Michail Katkoff made a point that the foundation of a racing game is mastering the race tracks and that the different cars, not tracks, should act as a variable of the driving experience. Players love racing games because they're about perfecting every corner and knowing each track like the back of their hand. Nevertheless Need for Speed, just like its main competitors CSR Racing and Racing Rivals isn’t a racing game even though it's sold to players as one. The best monetizing racing games are what you could call a collection game with linear power progression. There’s a very limited element of skill in the gameplay - unlike in traditional racing games.

Arcade games have their emphasis on the gameplay and skill-component overpower progression. The retention of these games is tightly tied to how addicting the core driving experience is. And it’s because of the freedom arcade can allow for. In an arcade you can bend reality to fit fun gameplay, e.g. doing insane and unrealistic jumps or football moves. But while bending reality can be really different for different sports and gameplays, it seems to be less fruitful for racing games. Generally speaking, in racing, you can be accelerating, steering, bumping into others, and sometimes shifting gears as well as braking and drifting. In order to stand out, it feels like any breakthrough in the sub-genre would have to involve some significant creative innovation in gameplay and/or in the marketing of the game. And while Mario Kart Tour has generated well over $100M inside the first year and continues to generate several million a month, this can be largely attributed to the 100M installs the IP has attracted. The same game with a different IP would arguably have made one-tenth of the revenue.

Angry Birds arcade racing game that launched back in 2013 showed the perfect product-market fit between a casual IP and Arcade Racing. The game quickly packed 100M installs but the poor execution on the metagame and live services kept from gaining any meaningful success on the revenue side. If Rovio is not making a sequel for this title, they should reconsider now that there’s a clear benchmark in the market to learn from.

To simplfy it, players come for the core and they stay for the meta. If the game lacks retaining and monetizing progression layer, the LTVs will be lower, which lead to bids for new players being low as well. That in turn makes the game rely even more on organic traffic and traffic from hypercasual titles, which as we’ve broken down before, is often not that interested in retaining and monetizing.

In 2020, the whole arcade racing sub-genre grossed ~$85M in IAPs while attracting ~700M downloads. Below are the games which earned more than $1M in 2020 with their share percentage of revenues and downloads from the sub-genre. We need to be careful with these revenues since they are only from IAP (in-app purchases) and don't represent the total revenue. A big part of the revenues in the arcade racing sub-genre comes from in-app-adds, but unfortunately we haven’t built a formula to estimate those, unlike we have for hypercasual and idle games..

Launched in 2019, Mario Kart keeps dominating the sub-genre in 2020 as well with a whopping 62% of revenue share despite claiming only 7% of all sub-genre downloads. It’s interesting to note that Mario Kart managed to grow its revenues for an amazing 49% compared to 2019. But that shouldn’t be a surprise since it was only launched in the late 2019.

Despite a strong launch in 2019 and recognizable IP, Mario Kart started and continued its decline in both downloads and revenues throughout 2020. So it turns out that the success of Mario is more due to the brand recognition than because of the game’s innovative design, meta, or monetization strategy.

Realistic Racing is keeping the race real

In 2020, the whole realistic racing sub-genre, comprised of games with real brand cars and core gameplay of driving, grossed ~$200M while attracting an amazing ~1.1B of downloads. The sub-genre saw a 35% increase in downloads followed by a 27% increase in revenues and as we said it was the driver of growth for the whole Racing category. The growth can be categorized into two groups of games:

Firstly, the group of older and already well-established realistic racing games led by CSR2. The genre leader grossed over $100M in 2020 and grew 23% YoY. As you can see from the charts below, in the last two years the game’s revenues have been stable but in Q2 2020 Zynga capitalized on the lockdowns leading to a staggering 40% revenue increase QoQ. That increase came from higher install rates in Q2 and arguably higher engagement during the lockdown led to increased spendings.

Need for Speed, by the fantastic EA Firemonkeys’ studio in Australia, had a 21% YoY increase in revenue following a similar growth pattern as CSR2. Firemonkeys another title Real Racing 3, which has been a top-three racing title ever since launching in early 2013 (!) actually shrunk by 5%. The biggest percentage of revenue increase comes nevertheless from Gameloft’s Asphalt 9 with a 44%. This makes Asphalt now the third-largest realistic racing game on mobile. Or fourth-largest racing game if we count in good old Mario.

Secondly, the growth was driven by the new entrants. There’s of course Rebel Racing from Hutch Games, but the impressive growth numbers are due to the game starting to scale in late 2019 and a 66% increase respectively. While the growth of Rebel Racing stopped due to poor revenue-per-install we will likely see this game back on the growth path in 2021. Hutch Games, got acquired by MTG for $275m (+$100m in earn-outs) in Dec 2020. Given the incentives and the newfound war chest, we’re sure that they will leave no stone unturned to find the growth.

Another two new games that managed to get into the top 10 realistic racing games are Trucks off-road and Hashiriya Drifter. They showed it’s still possible in this category to get to some decent success even if you are not a big company with tons of resources on your behalf. And unlike Rebel Racing, these titles are on a growth path.

Hashiriya Drifter was one of the smallest titles that seemed to find it’s growth track

Forza street mobile debuted in 2020 as well. And it was yet another utter crash and burn from Microsoft showing that the behemoth can make great games but has absolutely no clue on how to scale or operate a free-to-play game. To describe what happened based on our understanding when looking at the data is that Microsoft launched the game, got features from Google and Apple, and then decided not to invest in player acquisition. So it currently looks to be running mainly on organic installs making it likely just enough to support a small cadence team. Our advice to Microsoft is to acquire N3TWORK, which does have the chops to scale games but clearly has struggled in making ones that could be scaled.

Last Year’s Predictions

At the beginning of 2020 we set next predictions. Now it's a great time to look back and evaluate them.

2020 Prediction #1: Mario Kart will continue to decrease and flatten out. But it will continue to be the top revenue generator in the Arcade Driving sub-genre

Win.

2020 Prediction #2: No significant newcomer will enter the sub-genre. Arcade Racing will continue to be very fragmented and characterized by lower production-value, Hybridcasual titles.

Win. Another one. There weren’t any significant newcomers in Arcade Racing.

2020 Prediction #3: The top 4 titles in the sub-genre will continue to drive the lion’s share of the revenue in 2020. CSR2 will continue to dominate the category.

Win. In 2020 CSR 2, NFS, RR3 and Asphalt 9 drove 68% of sub-genres revenues (which, to remind you, increased 27% YoY) compared to 71% from 2019. Lion’s share.

2020 Prediction #4: CSR2 revenue will continue to gradually decrease, and the following 3 titles will stabilize at similar revenue levels in 2020 as 2019

Miss. 3 out of 4 titles grow their revenues for each more than 20% YoY. If there hadn’t been a pandemic, we’d have probably hit this right.

2020 Prediction #5: There will be no significant entry in 2020. Because of high development time and costs, and considering the fact that there is no major game in soft launch as of the writing of this prediction, it seems unlikely a title will be released in 2020 with the level of production value that is required to break through in the sub-genre. As a consequence, overall revenue in the sub-genre will continue to decrease in 2020.

Draw. As you could read, there were few new entrants but since they were on a lower scale of significance with low impact on overall sub-genre revenue.

The 2021 - Predictions

2021 Prediction #1:

Arcade Racing will continue to be very fragmented and characterised by lower production-value, hybrid revenue (ads+IAP) games.The probability of a significant newcomer with a high appeal IP like Disney, Loony Toons, Angry Birds entering the sub-genre next year is non-existent. Though we do hope that his analysis will make the IP holders reconsider.

2021 Prediction #2: It seems that nobody is even close to challenging the leader, especially in terms of f2p monetization. CSR2 will remain the sub-genre leader with more than 40% of market share in 2021.

2021 Prediction #3: We are going to see an increased competition for 2-5 spots. That competition will come from some of the old titles doing live-ops well and newcomers as well (Project CARS for example). Structure of the 4 games following the leader will change in 2021.

2021 Prediction #4: Since we believe this year’s growth was fueled by the lockdown, we expect to see a revenue decline for the Racing genre in 2021.